Consumer, Running on Fumes

If the consumer was just fine, then we wouldn’t have announcements of one business failure, or plant closure after another, here, here and here.

DoorDash (DASH) falls into the (completely) discretionary camp.

Does anyone really need this?

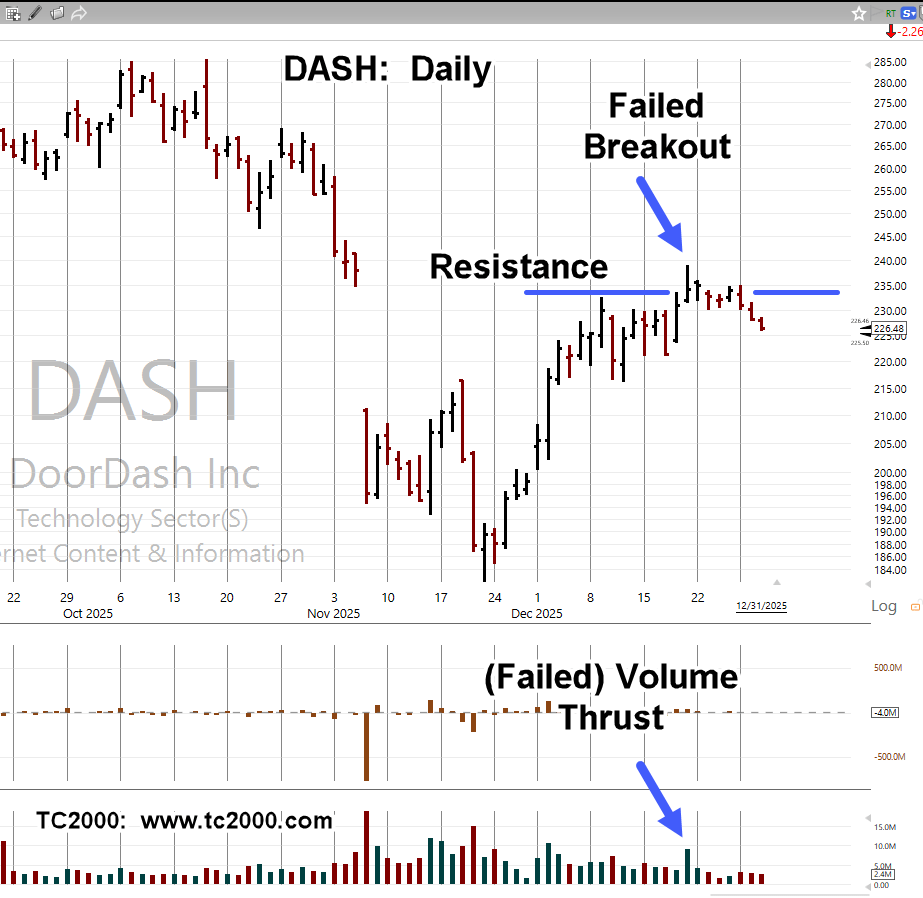

The chart shows a massive (largest ever) downward thrust on November 6th, from which DASH has been attempting to recover.

This past week, it looks like that recovery has failed (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

What do you make of the drop in unemployment claims? Seemed strange. Unless it’s just noise and I’m looking into it too much. I’m thinking it’s an opportunity to add more bond exposure.

LikeLiked by 1 person

Thank you,

I appreciate the question. Today’s post effectively addresses ‘fundamentals’, or any government so called ‘data’.

The government shutdown that was the longest in history should have shown everyone that fundamentals and data are not the ones driving the market. The market kept chugging along doing what it does, without any data.

If that data really mattered (or was accurate), price action would have been at a standstill.

Of course, the ‘news’ outlets are terrified to reveal this or discuss it. If they did, the public would realize the truth … and we can’t have that. Add to it, the public I talk to (in person) don’t really what to know the truth. So, I guess it works out for everyone involved.

I saw the headline article on the claims and immediately dismissed it as yet just another lie (not advice).

Actually, deciphering the price action is the hard part and Wyckoff said himself it literally takes years to master. Here’s a link to a trader that’s three years into the profession and is still not profitable: https://www.youtube.com/watch?v=w63ieulh010

I don’t have the heart to comment on her site and tell her she’s got at least another seven years to go … if she’s lucky.

At the same time, her journey may be shortened by publicly exposing the trading errors and taking action. Something that males would probably not do … well, except for this guy: https://www.youtube.com/@ImanTrading

A final thought. Years ago, Neil McCoy-Ward (https://www.youtube.com/@NeilMcCoyWard) discussed a series of diaries that were written during the Great Depression. I think it was as lest four videos.

Bottom line from those diaries, ‘no one (in the public) knew the full extent of the unemployment’.

Sounds very familiar.

Thanks again,

Paul

LikeLiked by 1 person

Well for me personally, If I can make money fairly consistently copying another traders ideas, then I’ll keep following that trader. That’s all there really is to it. There’s also so many reputable names out there providing free information so I don’t see the need to explore fringe avenues. The stuff that influences me the most is Lance Roberts and Jason Shapiro. I used to really like David Frost for the day trading stuff but he passed away unfortunately. All the resources at TraderLion seem really good. I’m starting to like your Peter guy over at shadow trader, that site is really good. Good place to learn options stuff. I know some other sites that are more geared towards investing or fundamentals but they make the content fun. The guy at FAST GRAPHS is cool. If you know any other good youtube channels let me know.

LikeLike

Pingback: DoorDash … Reversal Update « The Danger Point®