Like Newmont is to GDX, so is Amgen to IBB.

It’s the heavy hitter. If we decipher what’s going on with it, then we can trade biotech for (potential) profit.

The chart shows price action began to retrace off the lows for the week. In doing so, it created a possible neckline.

The 38% retrace area, marked with the dashed line, also shows it’s a juncture between weekly bars; the circled area.

That’s a trading tip … watch the circle.

If price action gets to 38% and stalls, it shows weakness.

Our interest is to look for shorting opportunities. Specifically, via the 2X Inverse Biotech, BIS.

For years now, except for energy (nat-gas) and commodities (corn, wheat, et al), markets are being worked from the short side.

Steven Van Metre presents an excellent case for a deflationary impulse first before there’s any inflation.

The ‘macro’ as he calls it, provides a backdrop for what’s really going on.

For now, the action (not advice, not a recommendation) is to watch AMGN play out. If the trading is choppy, overlapping and laboring into the 38% level, then we have our answer.

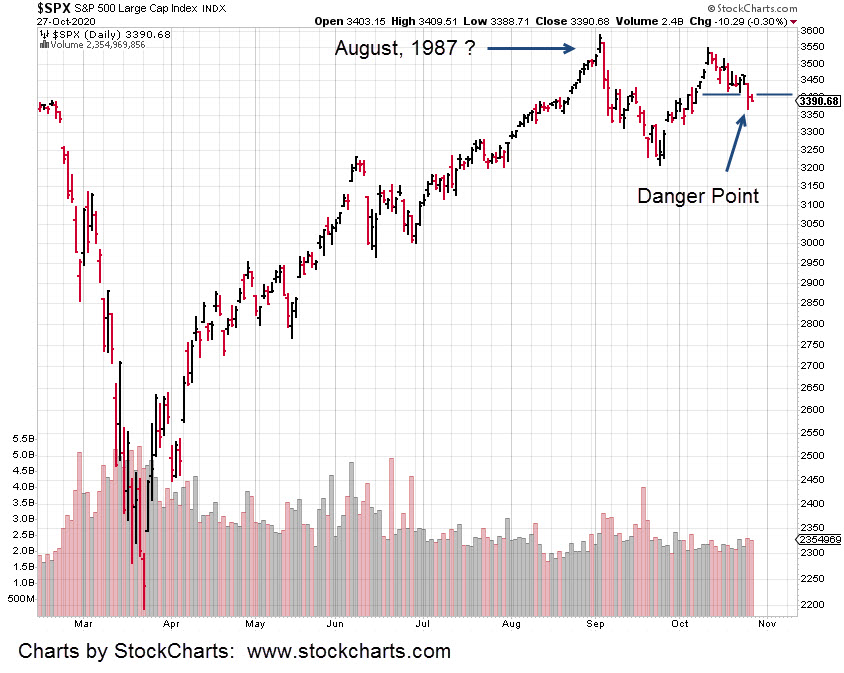

Charts by StockCharts