It’s Official

With a new daily low printed for biotech SPBIO, we’ve got confirmation of yesterday’s sell signal (not advice, not a recommendation).

To show that biotech is the weakest of them all, an updated chart (below) has the major indices ranked in order of downside action.

Prices as of 11:12 a.m., EST

Index Table

It’s a no-brainer (almost).

Even with the recent rebound, SPBIO remains the weakest.

From a Wyckoff standpoint, if one is going to short the market, his approach was to select the weakest sector(s) as they’re likely to fall farther, faster.

It’s the complete opposite of the amateur who spends his time trying to pick the top of the highest flyer.

We’re interested in opportunity; not bragging rights.

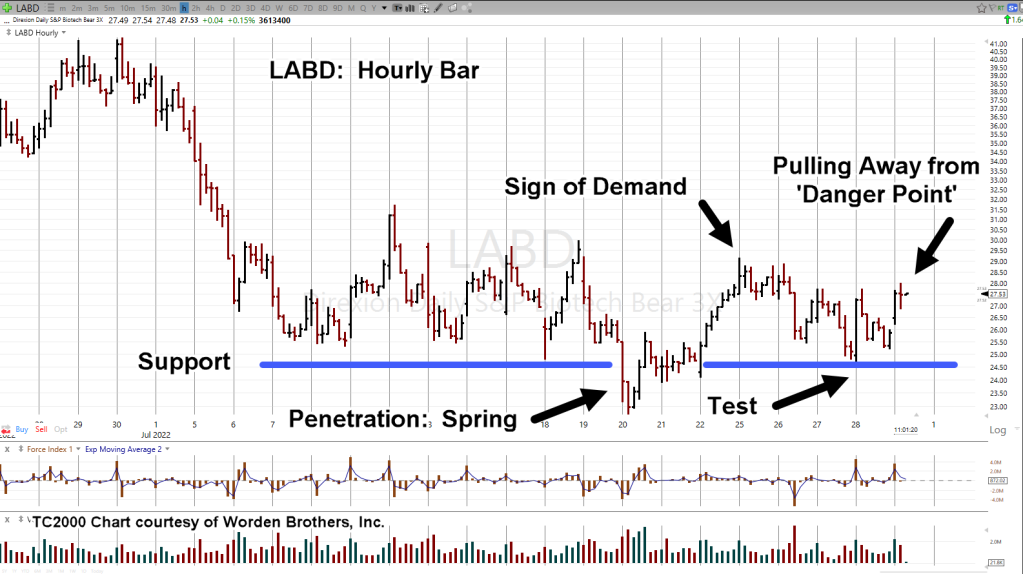

Let’s go straight to the 3X Leveraged Inverse Fund LABD, hourly basis.

SPBIO 3X Leveraged Inverse LABD, Hourly

Slowly but surely, LABD is competing the spring set-up and testing action.

If you’re not looking, it’s nearly imperceptible.

However, we’re still at the stage where the test can fail. We’re still at The Danger Point®

A reasonable soft-stop would be today’s low @ LABD 26.21, with a hard stop at yesterday’s low @ LABD 24.60

‘Soft-Stop’ meaning, if it’s hit, probabilities of trade failure have just increased significantly.

Summary

As can be seen on the side-bar, we’re short this sector with LABD-22-05, and TDA-LABD-22-02 (not advice, not a recommendation).

If price action continues to proceed as expected, the next update will show a repeating trendline that’s sure to catch one’s breath.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279