Quitting in Droves

Behind the scenes at Uber, we have this, link here.

‘Best days are behind us.’ Time stamp: 7:35

‘You could be riding around with a serial killer and not even know it’ Time stamp: 8:21

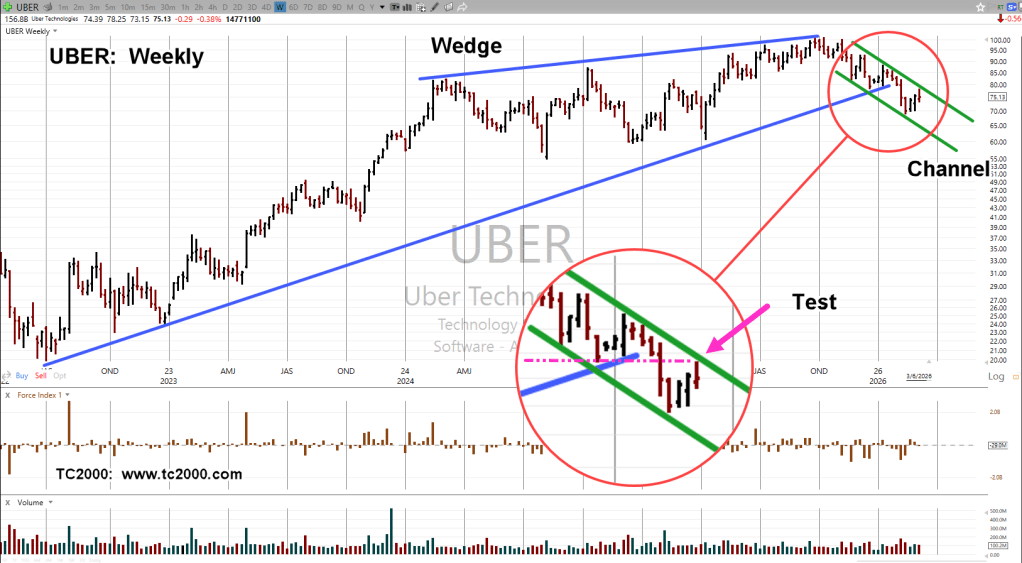

Looking at the chart, we have a terminating wedge, a trading channel and now this past week, a test.

Uber Technologies, UBER, Weekly

The dashed magenta line shows, price action coming up to test underside resistance, then closing lower (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279