Waiting for Probabilities

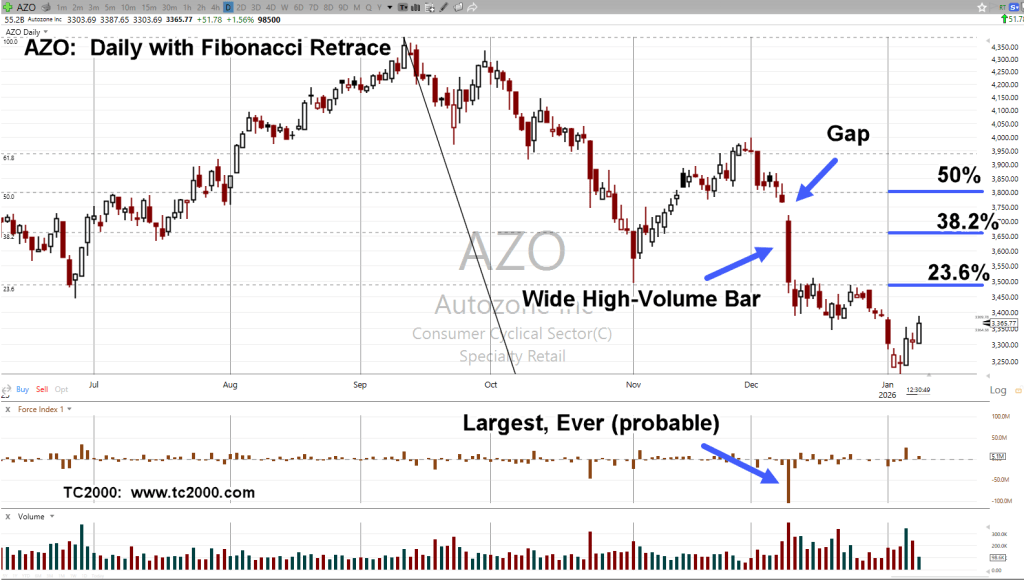

Looking back through historical data, downward thrust energy for AutoZone this past December 9th, was possibly the largest, ever.

In the case of DoorDash, here, we know for sure, downward thrust energy (November 6th), was the largest ever.

Spotify is also in the ‘largest-ever‘ camp with its record breaking downward thrust energy; posted back on July 29th, last year.

AutoZone AZO, Daily

One might think, it’s not possible for AZO to get back to the wide high-volume bar (not advice, not a recommendation).

Taking a look at DASH, show us, it’s indeed possible.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Market loves filling gaps. You could probably enter a short around 3,763 and watch the price immediately reverse. I’ve even seen gaps get filled down to the exact penny and no more.

LikeLike

I am new to trading and I don’t know much about gaps. Do you by any chance have data on probabilities of gap fills?

Thank you in advance,

Mitchell

LikeLiked by 1 person

Mitchell,

Welcome to this website.

Your question is a good one.

I personally have not collected any data on ‘gap-fills’. Yes, I know they do happen but taking that and calculating probabilities, is not part of my work.

Maybe Mr. Edward has that data or knows of a site (research paper or book) where it could be found or how it can be calculated.

ChatGPT gives sort of an answer but for AutoZone, it would be nice to know the probability for this case.

Thank you again. I appreciate the input.

Regards,

Paul

LikeLike

I don’t know the probabilities; I just try to figure out where to place orders. In the case of AutoZone, you could place the sell-short order around 3763. I don’t know if it will fill the gap a week from now, or a month from now, or if it will even fill the gap at all. But that doesn’t mean we can’t trade the support and resistance levels.

I used to use David Frost for day trading gaps but he’s since passed away. Here’s a video where he shows Disney and Ebay. Notice how the market came back to fill the gaps. Pay attention to the tails on the candles; these are places where we can place orders with high reward low risk probabilities. Furthermore, notice how the market respected the support and resistance levels very closely. It’s almost magical. It’s an old video but it’s just an example.

What I was trying to say, is that I very much believe that autozone is capable of reaching the fibonacci levels that were shown in TheDangerPoint’s post here. Especially the 50% level because that would also entail a gap fill. Obviously this David Frost guy has a different style and we’re not here to discuss him, but I do want to share my personal experiences of how TA can in fact work.

Just put a sticky note on your monitor for autozone and monitor it’s progress.

Learn How Day Trading and Scalping Gaps can make you a lot of money – YouTube

LikeLike

Any data you could provide to answer Mitchell’s question would be appreciated.

Thanks,

Paul

LikeLiked by 1 person