Sharpening one’s pencil to the nub, attempting to calculate corporate earnings down to the gnat’s gonads, is a futile task.

The consensus miss on the recent earnings release from Chicago Bridge and Iron (CBI) is just one case in point.

A much better approach, one that’s been proved since the early 1900’s is the method used at this link.

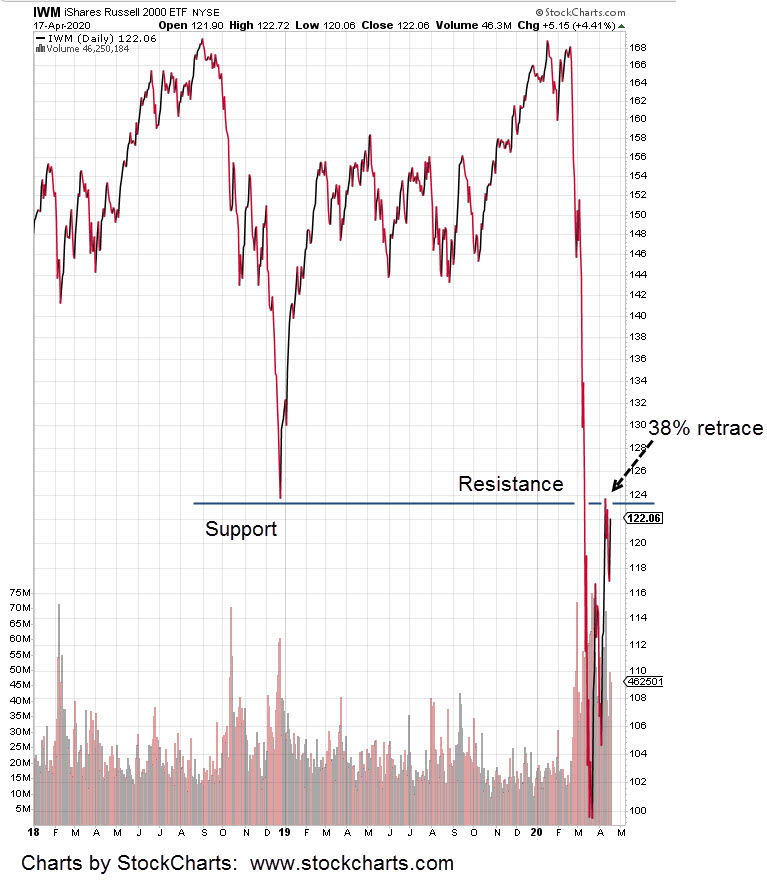

Clicking on the S&P Sector Archive shows two recent charts of the S&P 500. Price action of the market itself identifies the next likely direction.

A century ago, the father of technical analysis (Wyckoff) stated it himself:

‘The most important thing in Wall Street is to know what will happen next.’

So now the S&P has reversed. That fact presents the next question … what will happen next?

The answers do not lay in earnings reports, interest rate pronouncements or unemployment numbers.

The answer to market direction is in the market itself.

____________________________________________________________________________________________

For technical analysis on individual stocks, markets or indices, please visit our parent site at www.ten-trading.com