Hits ‘Target’, Then Reversal

Sales down, earnings down, car prices down, demand collapsing and yet, KMX, goes higher.

Frist off, let’s address the ‘clown show’ that bandies about ‘crash’ this, and ‘crash’ that … ad infinitum.

After you’ve said crash fifteen, thirty times or more on your YouTube channel, nobody’s listening when it really happens.

How about we all (myself included) take a cue from the late Dr. Martin Zweig as seen here, (time stamp 6:40) where he’s reluctant to say ‘crash’ even when it’s on the eve of Black Monday 1987.

Now, back to our update.

CarMax … Strategy

So, let’s review the CarMax situation from a calm but focused perspective.

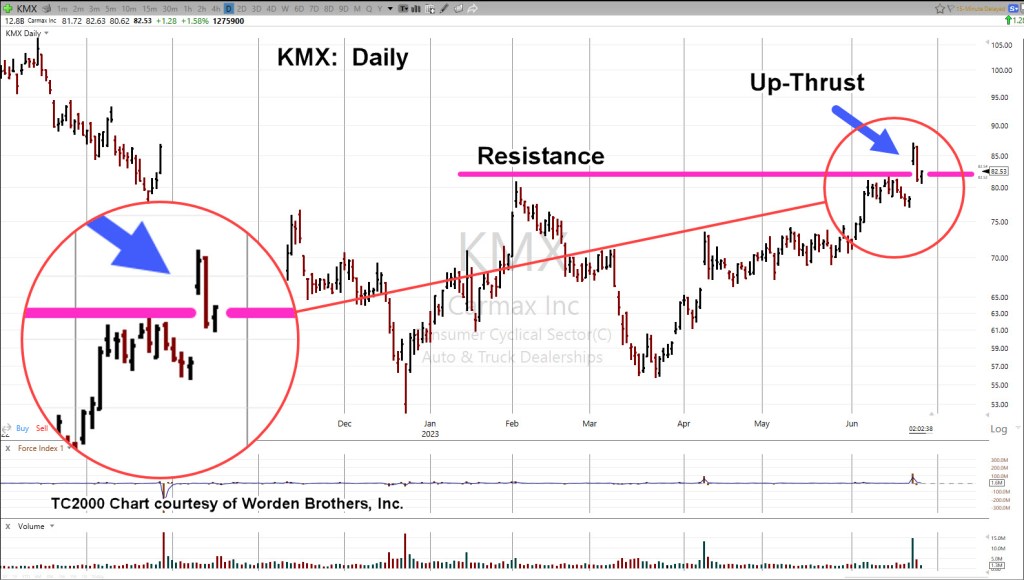

Strategically, KMX has met the price target identified last October (link here), and has apparently reversed.

The ‘Dead Cat’ Has Bounced

So, was last Friday’s earnings release high of 87.06, close enough to the ’85-area’ as forecasted?

“As the magenta arrow shows, there could be small blip up to resistance in the 85-area before potentially rolling over into a descent that projects to the 4.00, level.”

It took over eight months to get back to the ’85-level’.

What happens next?

Fundamental Forces

It’s been the premise of this site, we’re at the beginning stages of the largest financial, social, and population collapse ever seen (not advice, not a recommendation).

From a CarMax perspective, we have this just out yesterday.

Car lots are overflowing and we’re playing musical chairs with inventory to make it look like something’s happening.

Next, we have a Ford employee writing in, to Jeremiah Babe, saying the Electrical Vehicle Plant is a “ghost town”.

What does that ‘clean energy’ ghost town mean for silver demand? Ah, but I digress. 🙂

We’re most likely just getting started. For a snapshot into what may come our way, take a look at this.

Now, on to the chart

CarMax (KMX) Quarterly Bar

The original chart from October 2022, is repeated below.

Now, the update.

CarMax, KMX, Daily Bar

When looking at the daily, we see we’re in Wyckoff Up-Thrust (reversal) condition.

We’re at The Danger Point®

Just so we’re not one-sided, here’s a bullish forecast for KMX (not advice, not a recommendation).

At this juncture, there’re no plans to go short (not advice, not a recommendation) … although it may not be a bad spot considering all the forces lining up.

An obvious stop level (for a short) would be last Friday’s high of KMX 87.06 (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279