Time & Targets

Will it be like the old Ted Nugent song?

‘Kamikaze from the hundredth floor. Swan dive to the street.’

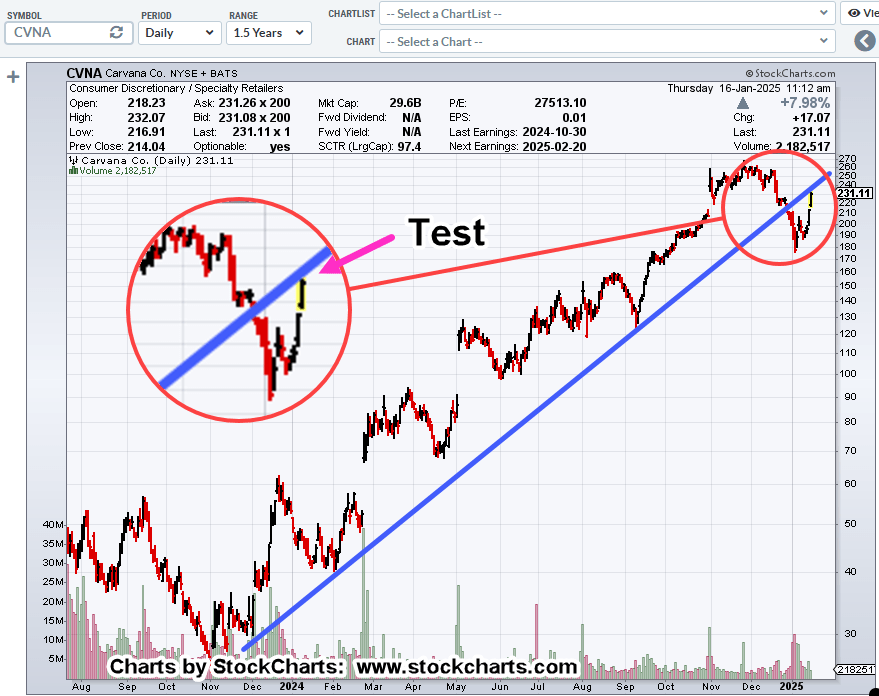

The last update wasn’t quite sure if we’d finished testing the trend break.

Now, with this morning’s session, there are more clues we may be getting closer (not advice, not a recommendation).

Looking back, this update had target(s) where price action could post before continuing the reversal (not advice, not a recommendation).

It was thought we’d get a rebound off the trendline. Instead, it looks like a test of the break.

No matter ‘how’ price action got to the target(s), it’s at the target. 🙂

Carvana CVNA, Daily

As of this post (11:26 a.m., EST), CVNA high for the day is 232.80, in the prior target range of ‘227 – 233’.

Today, is Fibonacci Day 34 (+1) from the all-time high posted on November 25th, last year.

If there’s going to be a reversal, price and ‘time’ requirements have been met (not advice, not a recommendation).

Adding to that, this update with Carvana (Hindenburg) ‘fundamentals’ in place.

Along with yesterday’s update, rate of economic decline increasing, it’s probable we’re nearing some type of inflection point (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279