Typical Phases of Reversal

Of course, it’s not obvious until it is, and then, it’s too late.

For Carvana, we definitely have the sentiment with the last earnings release.

A stellar quarter, but the future, not so much.

In just over two-weeks since then, bond prices are lower, rates higher and threatening to completely unravel, link here.

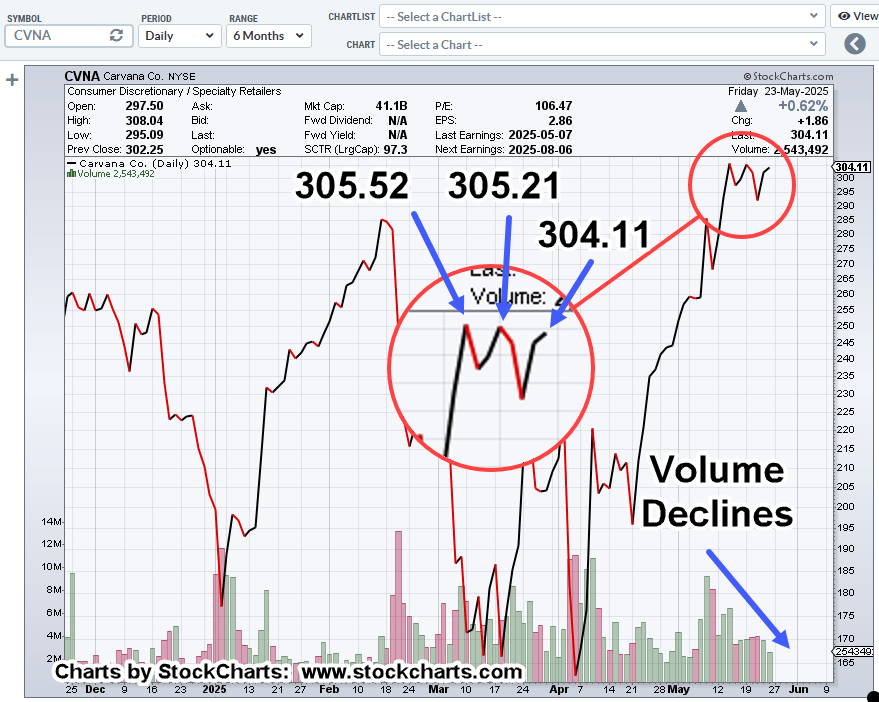

Carvana CVNA, Daily Close

Let’s put our recent (short) positioning activity into perspective.

That tiny little ‘blip’, at the far right, is where we’ve been attempting to position short (not advice, not a recommendation).

The area is expanded, below.

Prices are either congesting for a sustained launch higher or preparing to reverse.

That puts us at, The Danger Point®

Note that volume is contracting with Friday’s close, below the prior tops.

We have ‘sentiment’, now ‘volume’, then (maybe) price.

Positioning

Friday’s close could have been that ‘price’ part of the equation. We’ll see in the coming week.

The last update said, if there was buoyancy, CVNA-25-03, may be exited; that’s what happened.

Then, right at the close, another short: CVNA-25-04, with a stop near the session high (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279