Near The Reversal?

Nat-Gas, UNG slammed past the target forecasted five trading days ago, in this post.

Today, UNG opened gap-down, then traded down even more.

Currently (as of 1:10 p.m., EST), we’re at 14.38, down -3.88%, for the day.

Penetrating support to new lows, by definition puts UNG in Wyckoff ‘spring’ position.

That does not guarantee an upside reversal, it just means the conditions are met.

Strategy First

The potential for problems with supply have already been presented here, here, and here.

The human cost of what’s going on in our nation, can best be described by this post from Appalachia’s’ Homestead.

All of which brings us to the chart of Nat-Gas, UNG.

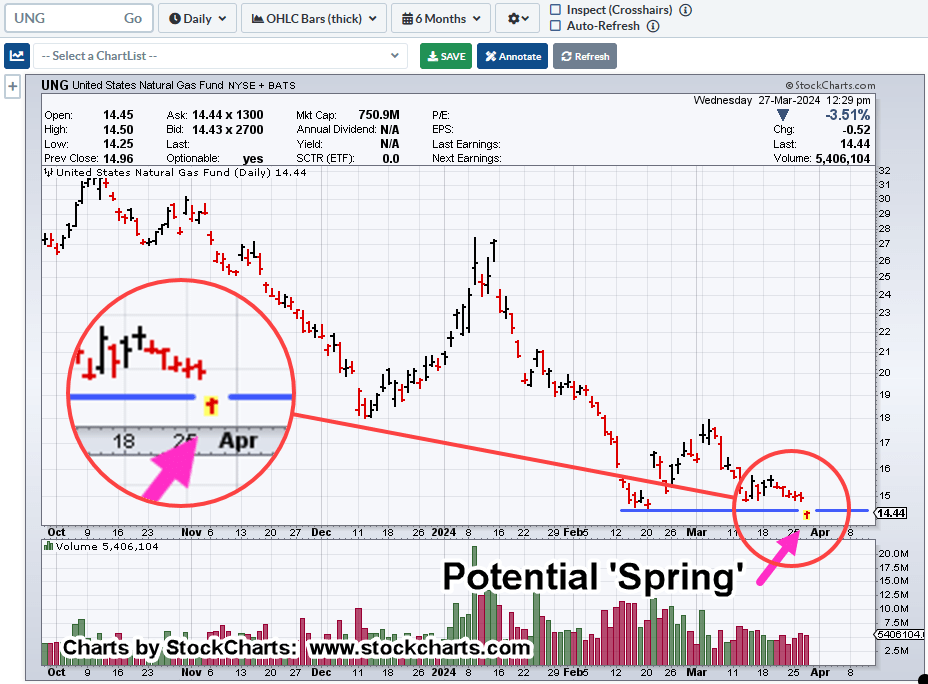

Natural Gas, ETF Proxy, UNG, Daily

The chart shows UNG, has penetrated support and is just ‘hanging’ there, unsure of what to do next.

It’s at The Danger Point®, where the potential risk of going long is least (not advice, not a recommendation).

Typical market behavior, is to come back and test a breakout whether it’s resistance or support.

For UNG, that would be in the vicinity of last week’s trading range, near UNG 14.90 – 15.00 (not advice, not a recommendation).

Summary

Know your market.

The futures for nat-gas are volatile and like to generate spikes both on the upside and down.

Tomorrow, we have the EIA nat-gas report; the possibility for more volatility is just one day away.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: The Thrust Is Gone … Nat-Gas « The Danger Point®

Pingback: Nat-Gas … The ‘Sleeper’ « The Danger Point®