A Look At Leveraged Inverse: SOXS

Just a reminder, the Inverse Fund trades contacts that rise in value if the tracking fund (in this case, the SOXX) declines in value.

Add to that some 3-X leverage and it’s a potential rocket in either direction.

The last update on the SOXX, link here, said we’re at The Danger Point® and since then, nothing has changed.

At the open today, SOXX posted an attempt to launch higher that was quickly reversed. Price action then spent the rest of the day in a narrow trading range.

So, what happens now?

For a look at the probabilities, we’re going to use the 3X leveraged inverse fund SOXS.

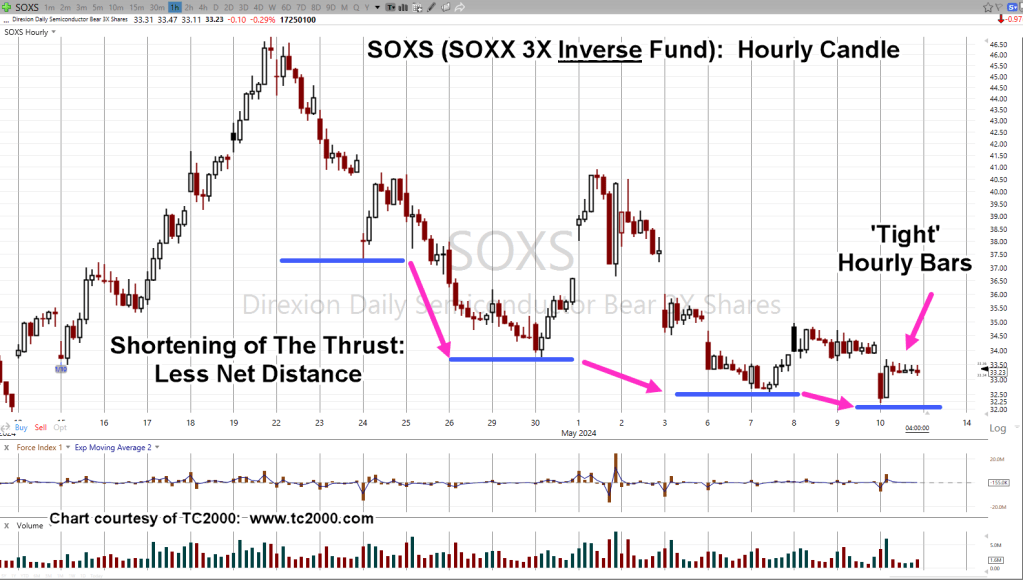

Semiconductors 3X Leveraged Inverse SOXS

What we’re highlighting here on the hourly, is net distance traveled on the down move (upward in SOXX), getting shorter with each successive thrust.

Add to that, ‘tight’ hourly bars for five-hours of the trading session.

Tight action precedes (typically) some type of directional move or breakout (not advice, not a recommendation).

Obviously, with tight action in the upper half of the day’s trading range, one would expect a directional, breakout move to the upside (downside for SOXX).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: SOXX Action … Tight & Tighter « The Danger Point®