‘There’s … No Demand’

The tagline above, paraphrased from the Chief Operating Officer of SD Bullion (time stamp 5:47, link here), is telling us all we need to know.

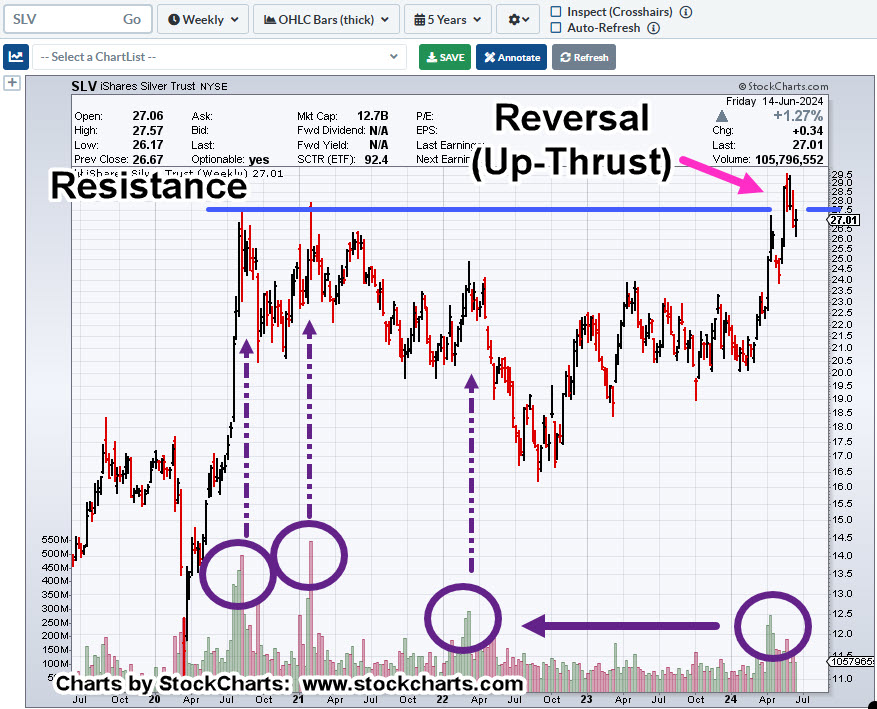

Over two months ago, that ‘no demand’ potential was reached by reading price action of SLV, itself (not advice, not a recommendation).

Back then, posted here, was this (emphasis added):

“Just listening to what the market’s telling us, it says, when SLV, reaches a top and inflection point (to reverse lower), it tends to print heavy upside volume bar(s).”

With the caveat that ‘anything can happen’, let’s take a rational look at what SLV, price action is telling us now.

Silver SLV, Weekly

Based on prior action (circled areas), it’s not looking good for the bulls (not advice, not a recommendation).

We’re at the spot where there needs to be outsized demand to get SLV, above what’s now well-established resistance.

If the COO of SD Bullion himself says ‘there’s no demand’, then where’s that ‘outsized’ breakout demand going to come from?

With this being the seventh update on the (potential) reversal in SLV, this series is complete.

As a parting shot, buried within the interview (link above) is the hint; dealers, just like everyone else are scrambling for cash; yes, ‘fiat cash’.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279