It Does Not Mean, What You Think It Means …

Like something straight out of The Princess Bride, this morning’s Broadcom (AVGO) explosion, probably doesn’t mean what the ‘investing’ public thinks it means (not advice, not a recommendation).

The link above, tells us AVGO, has launched higher on a ‘bold A.I. forecast’.

A Forecast !!! … what maybe could, or might happen in the future, if nothing bad happens along the way, … maybe.

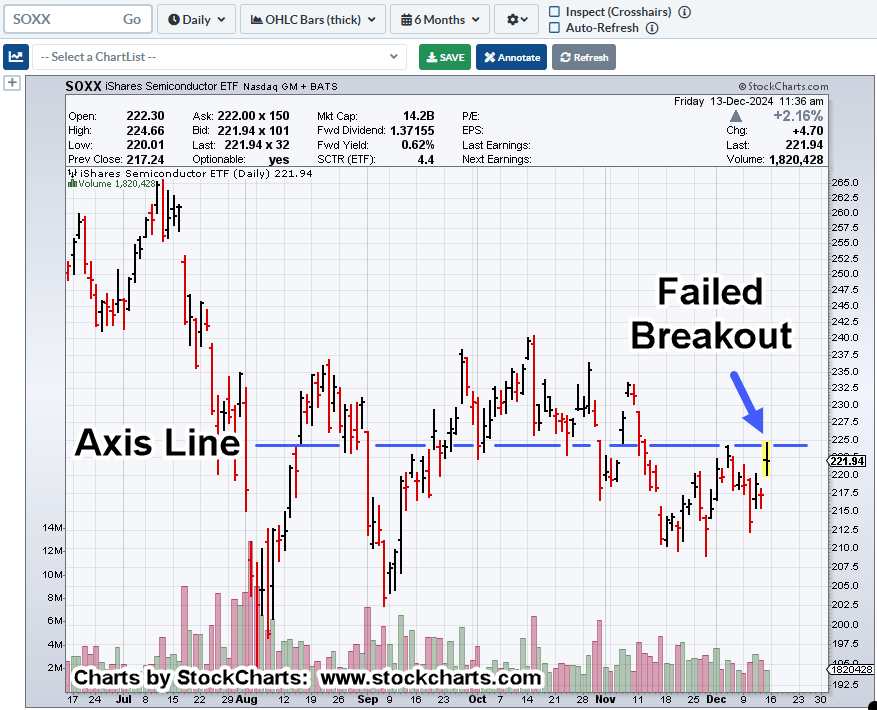

Well, let’s go to the sector itself, the SOXX, and see what the market’s really telling us.

Semiconductors, SOXX, Daily

The bubble trend break discussed here, remains intact.

Any number of notations can be made on this chart.

There’s a downtrend line from the October 15th high (not shown), with today, as the fourth hit on that line.

The low of November 27th, to today, could be classified as ‘spring-to-up-thrust’.

The list goes on.

However, the main point, and to leverage on yesterday’s update, is this:

If the building blocks of economic activity (Basic Materials) are in a (potential) long-term reversal, how are any of these so-called A.I. ‘data centers’ and the associated infrastructure going to be built?

Asking for a friend. 🙂

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: A Tale of Two Markets « The Danger Point®