Using The Nvidia Model

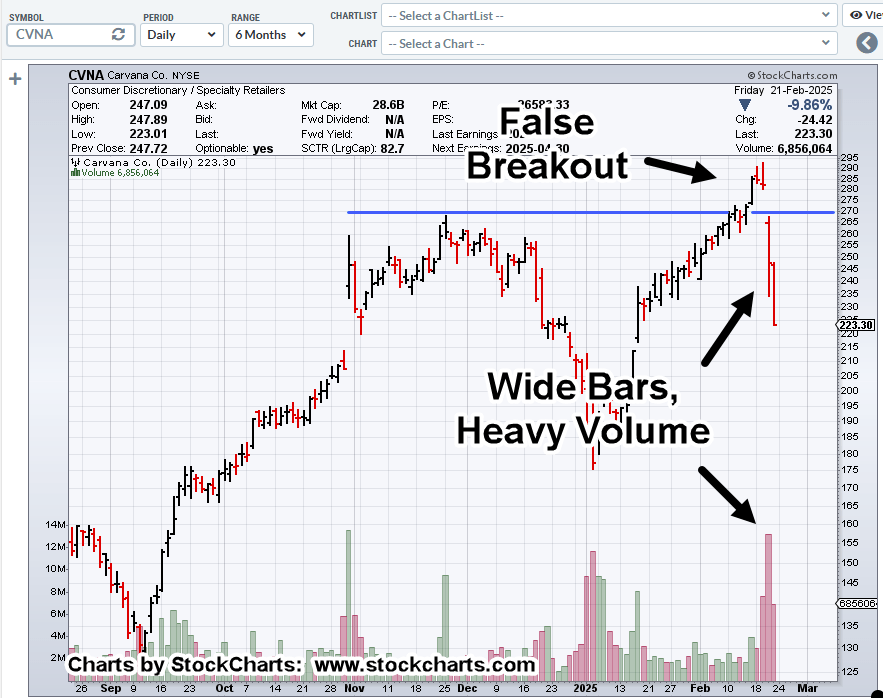

In the after-hours, post-earnings, Carvana spiked to exactly 310, the lower end of the range presented here.

Then, ending the (regular session) week down nearly -22%.

In a similar fashion, Nvidia had its own collapse; down -17%, on ‘DeepSeek’ fears.

As always, the question is, ‘what happens next?’

This Plan, or That

From here, literally, anything can happen.

Carvana could continue straight down and implode (not advice, not a recommendation).

It could do nothing and just post sideways action from here; not likely, but it could.

Or, behind Door Number 3, Carvana model’s Nvidia.

That is, finishing its initial downward thrust, then a retrace to test the wide bar(s), high volume.

Carvana CVNA, Daily

On a percentage basis, CVNA has weaker action (which may not be finished) than NVDA.

The ‘Short’ Side

If the market begins a persistent decline, will the SEC ban short selling as it did in 2008, link here.

It’s important to note, immediately after that announcement, the market absolutely cratered on massive volatility; the Qs dropped over -41%, from that point.

This time around (if it happens), with a new Sheriff, will there be a short-selling ban?

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279