Exit & Set-Up

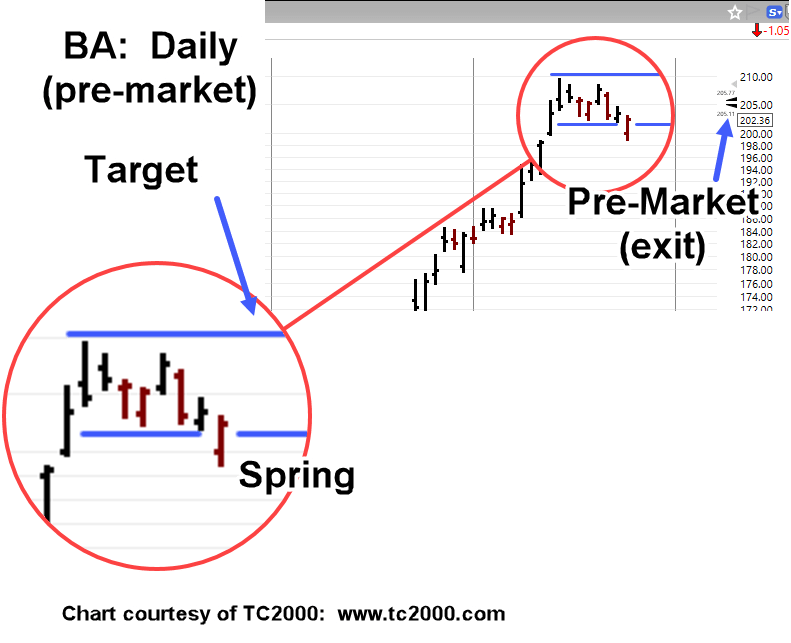

It’s never fun to wake up ‘in-the-red’ but that’s where Boeing BA-25-02 (short) was in the pre-market.

Based on the chart, with Friday’s lower close, price action had one of two choices; post lower and continue the decline or push higher from the spring set-up as shown.

Looks like we’re set-up to see if the (up-thrust) target area is met (not advice, not a recommendation).

With that said, the short was exited pre-market with an overall loss of 0.99%.

Boeing BA, Daily (pre-market)

Note, from the high on 5/14, to the low, last Friday, is Fibonacci 8 Days.

If the correlation remains intact, we’ll be looking for a potential target set-up, on Fibonacci Day 13.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: (more) Pre-Market … Boeing « The Danger Point®

Pingback: Boeing: ‘Pick Me’ « The Danger Point®