On A Closing Basis

The goings-on, in the car market, new or used, are unprecedented, link here.

The video is clear; the market has already imploded.

Carmax (KMX) seems to be an accurate reflection of that, with it being down over -62%, from its all-time highs.

However, for some mysterious reason that’s (almost) sure to come out later, Carvana, is only down only -17%, from its all-time highs.

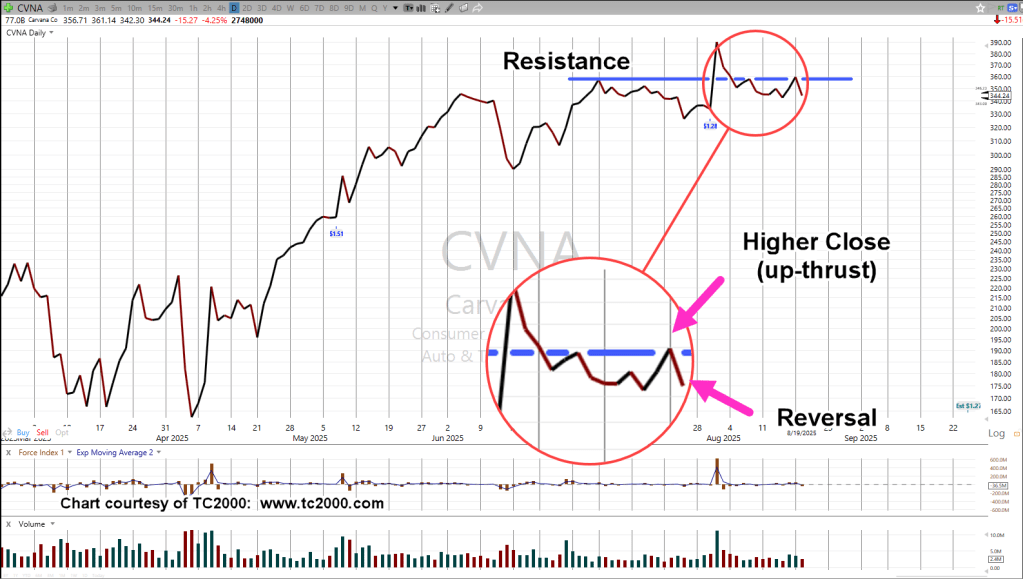

Carvana CVNA, Daily Close

On a close basis, CVNA tested resistance, posted an up-thrust on the 18th, then reversed.

Adding to the intrigue, that up-thrust was on Fibonacci Day 13, from all-time highs.

Referring back to Livermore’s criteria, link here, if the trade meets requirements (i.e., up-thrust), then execute.

In this case, that meant to go short (not advice, not a recommendation).

Short trade: CVNA-25-11, with stop at today’s session high (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

I like that guy’s channel (Car Questions Answered). His business really slowed down around April.

LikeLiked by 1 person

His channel is the only one (I know) that shows those on the outside ‘how it’s done’, the car auction process. His boots on the ground tell us the market for new and used has imploded. Or maybe phrasing it a little more accurately, only the ‘haves’ can afford a $110,000 Grand Wagoneer.

Of course, that’s in the background. Actually mapping that to price action, is the hard part. 🙂

At least when the whole thing collapses, we won’t be surprised and watching mainstream news about how ‘nobody saw it coming’.

Regards,

Paul

LikeLike