Is This It?

If there’s trouble, high yield bonds typically break down (rates higher) early in the cycle (not advice, not a recommendation).

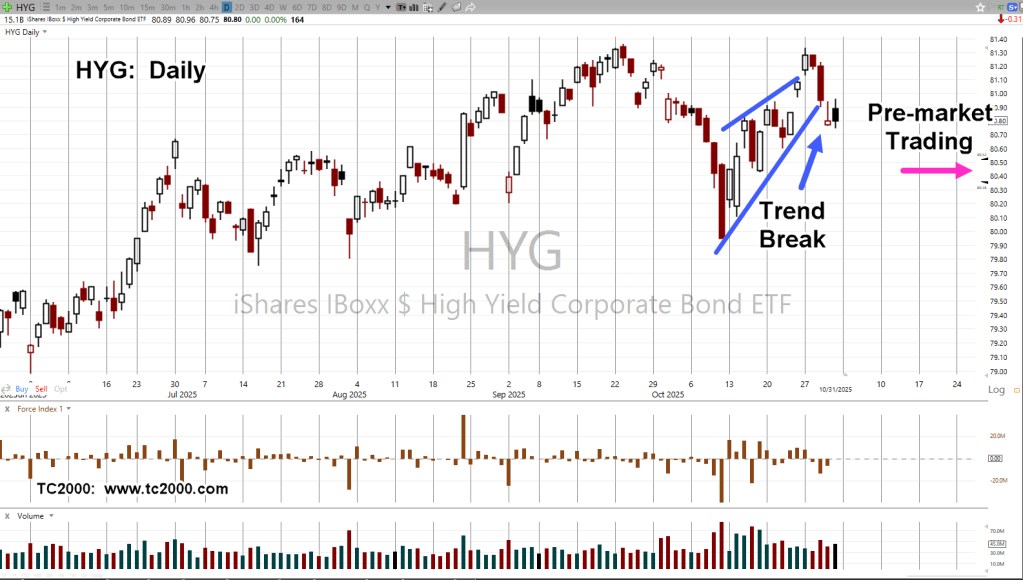

When looking at the chart of ETF sector fund HYG, that’s what we have.

A rising, terminating wedge, then break to the downside.

High Yield, HYG, Daily

The magenta arrow shows pre-market trading (as of 7:55 a.m., EST), significantly lower.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

I wish credit spreads would widen since I own so many treasurys. But I was listening to keith mccullough today and he quoted a guy who said “57% of institutional managers are concerned about private credit.” Which isn’t exactly the same thing as publicly traded junk credit but you get the point; too many people are worried about credit. So strictly looking at this from a psychological point of view, it would seem unlikely that the credit markets bring down the market. It’ll be something else.

LikeLiked by 1 person

Yes,

I believe you are right, ‘something else’ is going to happen.

Everybody is looking at the usual suspects but all the while it’s probably an unforeseen event maybe not even related to finance that causes the shock. Something like a cyber-attack that causes all the food shipments to stop.

That will get everyone’s attention especially those stacking metals that you can’t eat.

I’m not against ‘real money’. My opinion is, that it’s premature. The food comes first, then the metals (not advice,).

Thanks again,

Paul

LikeLike