Bear Market Bounces

Home builders, and home improvement stores (HD, LOW), were up across the board on a policy announcement to support the housing sector.

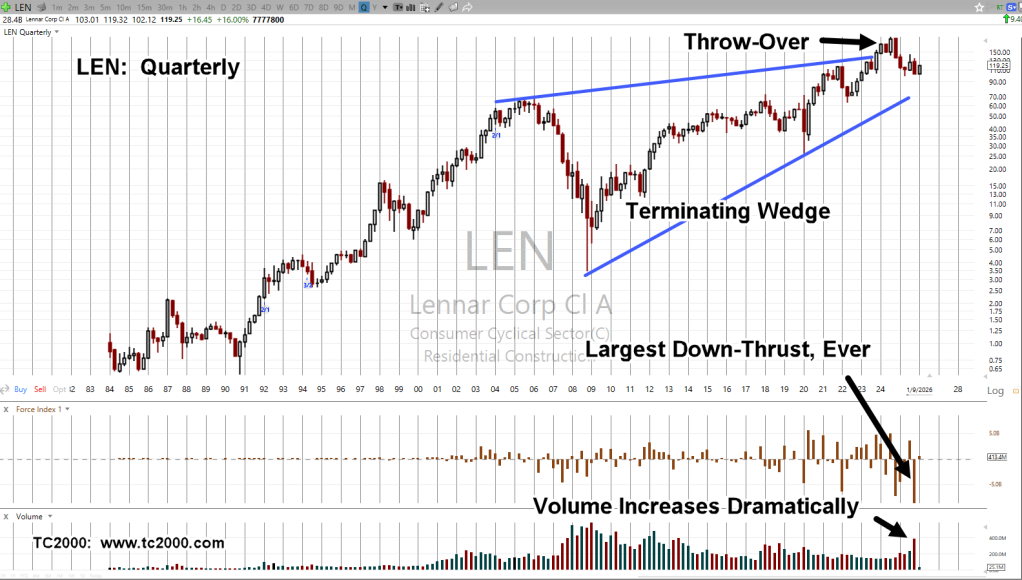

Of the top three (market cap) builders, DHI, LEN, PHM, Lennar (LEN) has the weakest price action as we’ll see below.

On this site, we’re interested first, in the strategic position of the market; then, second, the tactical opportunity for a directional move.

Thirdly, is the focus part. There’s no ‘diversification’ but a zeroing into what price action says maybe the best opportunity (not advice, not a recommendation).

Strategic Position

The ‘Residential Construction’ sector topped-out way back in October, of 2024.

As of Friday’s close, even ending the week +10.2% higher, it’s still down (from all-time highs) -18.29%

Lennar Corp LEN, Quarterly

Looking at the long-term view.

The chart says it all.

Lennar looks ready for ‘implosion’ (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279