A ‘Basic Material’

A ‘blip’ is all there was.

The last update on silver SLV (link here), had this to say:

“The 50% retrace area is shown. It will be interesting to see if SLV, gets that far.”

Well, SLV got that far, just barely, held for three days and then reversed, ending the week down.

While the hyperinflation mania rages on, click-bait by click-bait, the market itself tells us the truth … or the more probable truth.

That truth (below), silver (SLV), is poised for a series of downside reversals (not advice, not a recommendation).

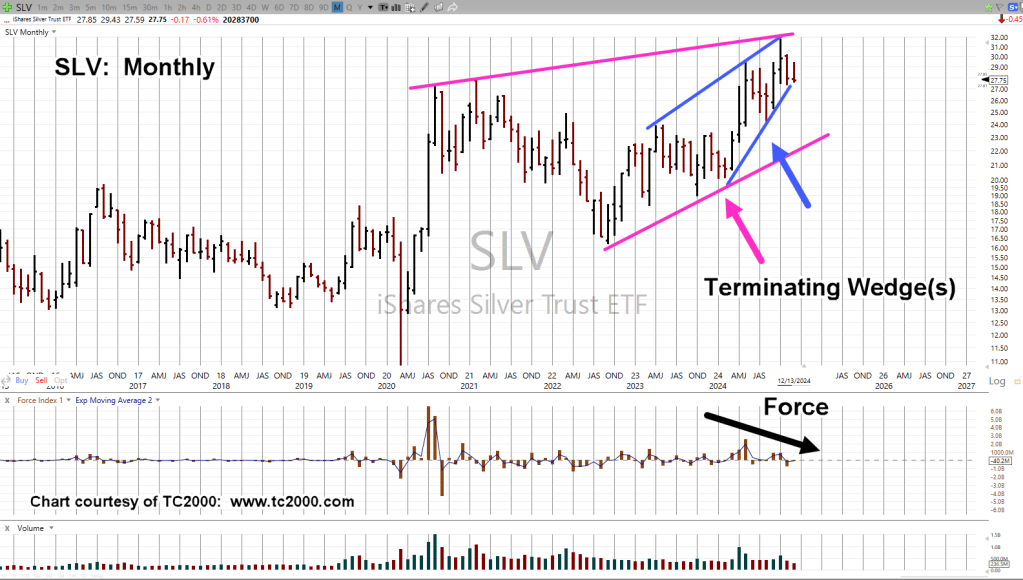

Silver SLV, Monthly

One ‘terminating wedge’ within another; upside Force (pressure) is declining and bearish divergent (not advice, not a recommendation).

Silver may be considered a basic material like copper (also in decline) with over half of production used for industrial applications.

The COP-OUT

There’s dissent in the ranks.

As economies are stressed or fracture world-wide, the amount of free money available for ‘games’ essentially evaporates.

Case in point is here.

Already shown, the effects of economic decline (silver demand) with solar company bankruptcies, link here.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279