10:56 a.m., EST

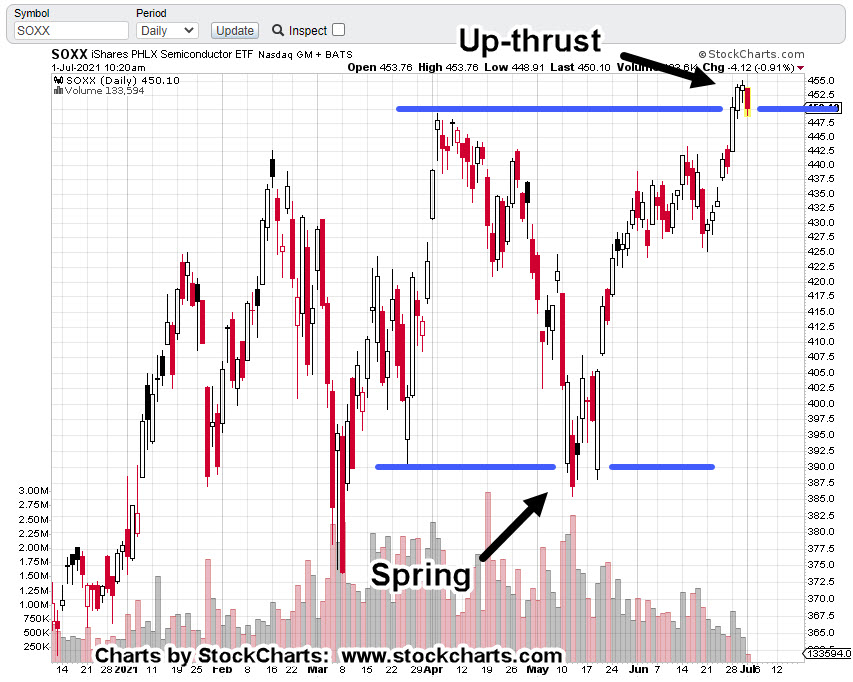

Semiconductor SOXX, at Danger Point

‘Spring-to-Up thrust’ is a common price action phenomenon.

Credit goes to the late David Weis for noting this behavior in one of his daily market updates from years past.

Now, we see it in action with SOXX.

As with airlines, semiconductors are highly susceptible to economic changes. Both operate on thin margins and have high capital costs.

Airlines (at least UAL and AA) have never recovered to new all-time highs. Maybe the semis went higher because of all the contract tracing that’s being projected.

However, noted in yesterday’s update, there’s a chance there won’t be much to ‘trace’; we’ll find out very soon.

SOXX is at the danger point; risk of a short position (not advice not a recommendation) is at minimum.

As an extra reminder, we’ll add a frequently discussed theme for market tops: ‘Holiday Turns‘

Emperical data shows that markets tend to reverse before, during, or just after a holiday week.

This week could be one of those.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

Pingback: Downside Leaders: Gold, Biotech « The Danger Point

Pingback: SOXX: Textbook Top? « The Danger Point