Looking For The Set-Up

Intel’s a dog … and has been for a very long time.

How do we know that? The price action itself, tells us.

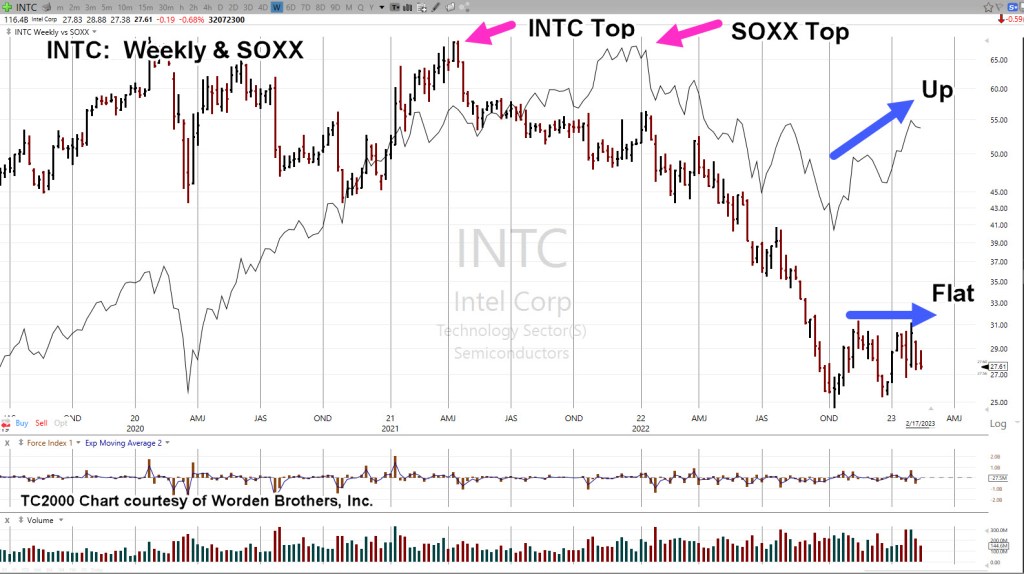

Looking at the weekly chart of INTC, overlaid with the SOXX (thin black line), it’s clear, things literally went south for INTC, right around April, of 2021.

Intel reversed while the sector, the SOXX continued higher.

It’s what happened next, that’s important.

Intel INTC, With SOXX, Weekly

Note how the SOXX has rebounded since mid-October last year while Intel has remained flat.

Even with all the market manipulation to keep the major indices trending higher, having the public thinking ‘the consumer is strong’, INTC has languished.

This lack of upward price action in a rising market, indicates significant weakness.

Has Intel reached a bottom? This is the ‘dip’, isn’t it?

‘Go ahead, make my trade‘. 🙂

As always, anything can happen and INTC, could launch higher from here. However, it’s not likely.

It’s a juggernaut and at the moment, heading lower.

All of which brings us to the set-up: Options trade to the short side.

Intel INTC, Daily

For a viable Put trade, at least two criteria need to be met (with downtrend already established) and those are: Option time bleed, and what’s called ‘price instability’ or a ‘test’.

The daily close of INTC, shows a prior set-up (‘Test’) and now, at the far right of the chart, forecasted action.

A possible time for the ‘test’ if it occurs would be this coming Wednesday as that makes it ‘Day 13’ from the high on February 3rd.

That day would also coincide with the Fed minutes being released at 2:00 p.m., EST.

Note: When Fibonacci time counts are involved, it was determined years ago (by my firm), when the U.S. market is closed for a holiday and the rest of the world markets are open, it can (and sometimes does) count as a Fibonacci trading day.

Therefore, with world markets open this Monday, and the U.S. closed, it may still count as a Fibonacci trading day.

That in turn, could make this Tuesday ‘Day 13’ (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Intel (INTC) … Up To Test « The Danger Point®