At The Danger Point®, Where Risk Is Least

It does not get much better than this.

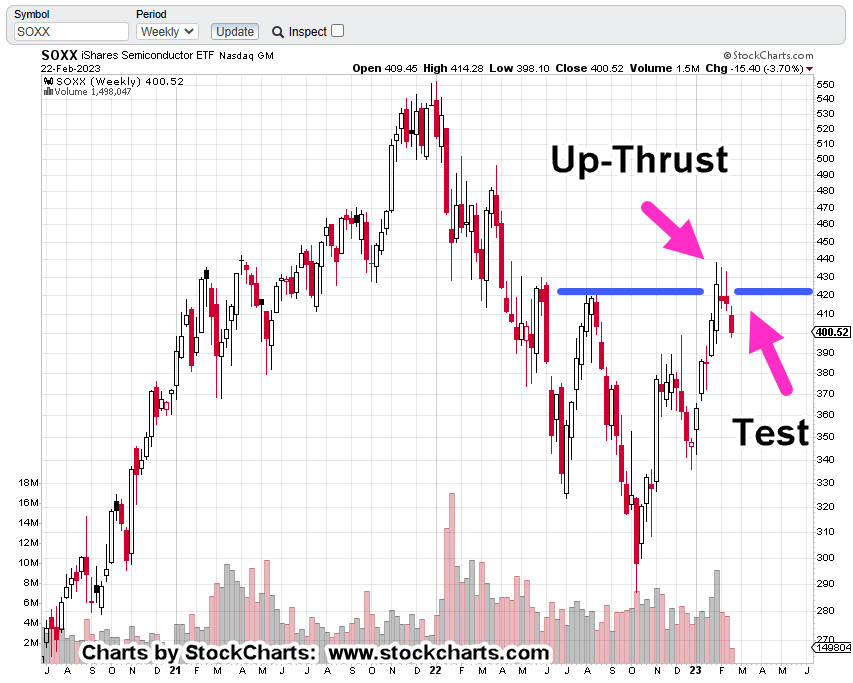

The weekly chart of semiconductor index SOXX (below), shows we’ve already had the Wyckoff up-thrust, the reversal.

All that was missing was the test. That is, until today.

The reportedly ‘good news‘ from Nvidia has given the SOXX the excuse to test its reversal.

Pre-market action has Nvidia itself is up +10.61%, and the SOXX currently up +2.42% (8:32 a.m., EST).

Conversely leveraged inverse fund SOXS is down – 7.15%. This is the opportunity (not advice not a recommendation).

Semiconductor Index SOXX, Weekly

With the SOXX open set for higher, risk on a short position (via 3X Leveraged Inverse SOXS) may be reduced as much as the market is going to allow.

Less risk is NOT, no risk.

The market is going through its natural tendencies, and this is an area where there could be a short opportunity (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279