In A Knife Fight? … No Rules !

What’s happening in the markets is important but so is what’s not happening.

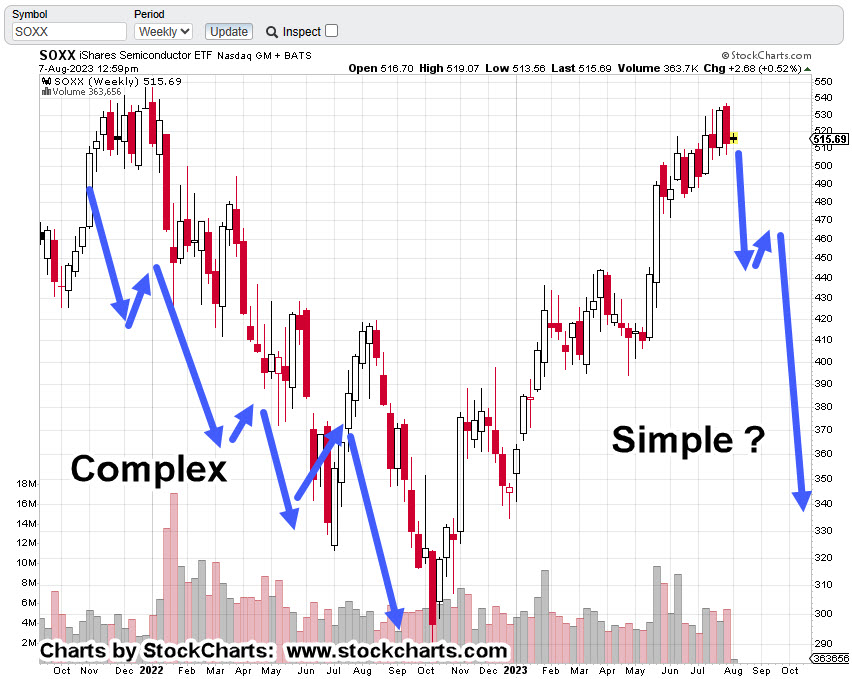

The SOXX, as of 1:15 p.m., EST has not made a new daily high.

Price action’s hovering in a tight range and looks to be coiling for a directional move.

If the breakout is to the downside as anticipated, here is where the ‘rules’ come in.

The ‘Rule’ of Alternation

Originally discussed by Prechter years ago, as an observation, the rule is basically described as:

‘The market will alternate in wave structure from complex to simple or from simple to complex.’

When we look at the SOXX, the implication is, we may be due for ‘simple’ wave structure (not advice, not a recommendation).

Semiconductors SOXX, Weekly Candle

The weekly chart shows the potential.

The first leg down was complex, overlapping price action.

If there’s a break to the downside, the ‘rule’ says to expect price action to alternate from a prior complex structure, to simple (not advice, not a recommendation).

The Maverick of Wall Street

One recent example of such a move can be found at this link, time stamp 11:20.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Stupid ‘AI’ Short-Sellers « The Danger Point®

Pingback: AI Fails To ‘Follow-Through’ « The Danger Point®