The Shills Emerge

‘…. and reminds you, she was only in it, for the money ….’ Steve Goodman

Seems like any time gold or silver blips higher, the shills come out; a new book to sell, more metals to peddle.

Obviously, what’s presented on this site, is neither; we’re searching for the truth, market truth, nothing else.

When looking at Junior Mining (ETF) Index, GDXJ, once again, it’s at The Danger Point®.

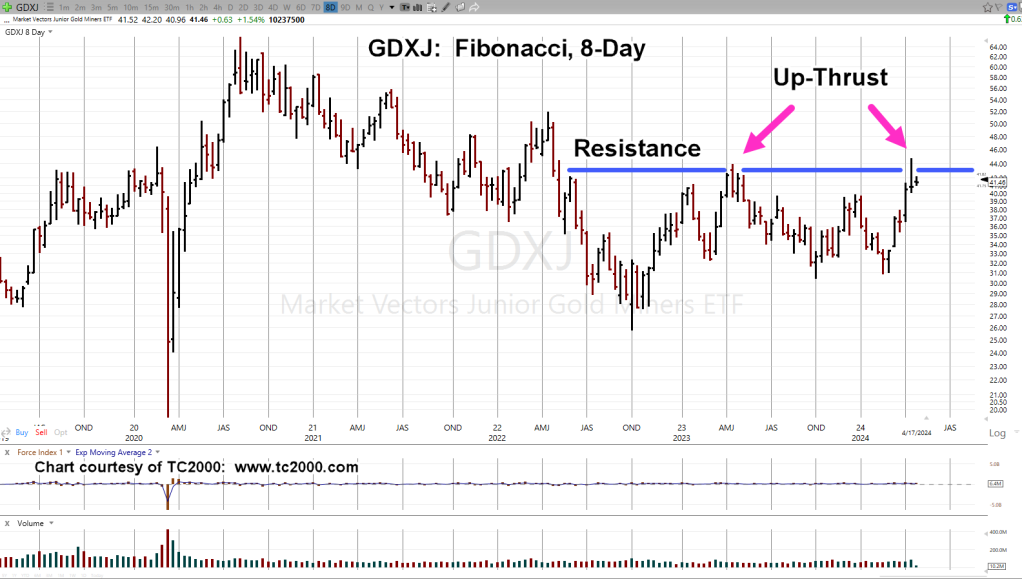

Junior Miners, GDXJ, Fibonacci 8-Day

The 8-Day chart gives us a clear view of the action.

There was an up-thrust during the week of April 14th, 2023.

Now, a Fibonacci 55 (-2) weeks later, another one during the week of April 12th.

Last Time, Is Not, This Time

The up-thrust in April ’23, resulted in a steady but choppy downside action until the bottom, February, this year.

Using Prechter’s ‘rule of alternation’, whatever happens from here, it’s not likely to be what happened last time.

So, essentially, we have two potential outcomes; strengthening with continued upside, or a swift decline back to support levels (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279