Everybody Knows, AI’s The Way To Go

As if on cue, we have this piece of propaganda out from the mainstream.

‘AI short sellers lose big‘

Of course, there’s some truth … that in-total for the year, short positions have not been continuously profitable.

Contrary Indicator

The article represents another (potential) contrary indicator; short sellers (those that are left) may be about to ride the wave down (not advice, not a recommendation).

As the AI mania collapses, we’ll have the same set of clowns demanding short-selling be banned. 🙂

So, let’s see what our favorite AI chief cook and bottle washer’s doing in today’s session (as of 11:30, a.m., EST).

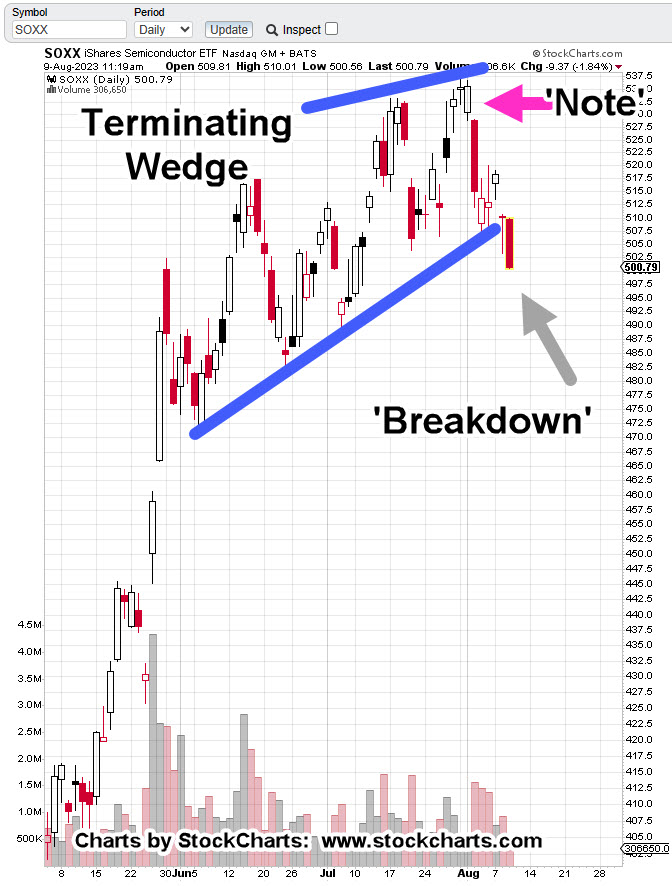

Semiconductors SOXX, Daily Candle

Ruh-Roh Scooby.

The daily chart has a terminating wedge that’s now breaking to the downside.

The magenta arrow with the ‘Note’ indicates, the current reversal was identified to the day; link here.

The dangerous part is, if the SOXX follows the ‘rules’ laid out in this link, it’s likely to be a swift and merciless decline (not advice, not a recommendation).

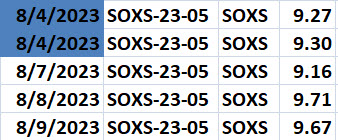

Positioning

With no obligation to do so, here is how I have addressed the SOXX, set-up thus far (not advice, not a recommendation).

Note: SOXS, is a ‘leveraged inverse’ fund for the SOXX

August 4th had two entries same-day, as noted.

This series is the fifth trade campaign in the SOXS for the year (SOXS-23-05).

Hard Stop is today’s session low of 9.46 (not advice, not a recommendation).

Obviously, with the SOXS currently at 9.97, all positions are well in the green.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: AI Fails To ‘Follow-Through’ « The Danger Point®