Is Now, The Time?

Let’s remind ourselves why there’s trading interest in Nat-Gas; putting it succinctly, ‘disruption‘.

We have disruption in nearly everything else (food supply, auto parts, medicines), why not the infrastructure?

The premise for the opportunity (if one can call it that), was discussed months ago. The work, the idea, the strategy has already been covered.

It turns out, other professionals had the same idea, prompting this update.

Those speculators needed to be washed out before a potential set-up could be created.

We may be there now; Nat-Gas proxy, UNG, is at The Danger Point® (not advice, not a recommendation).

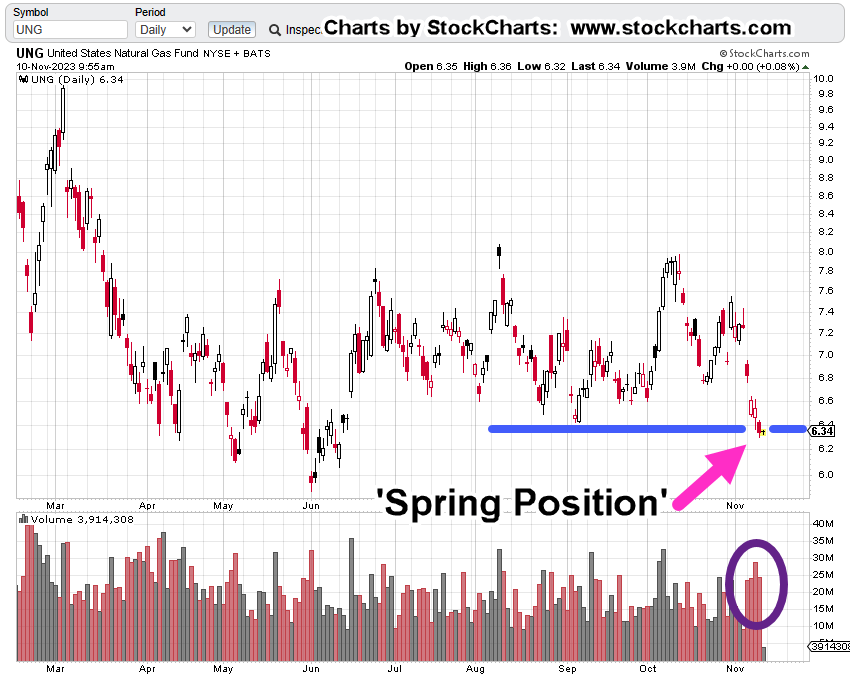

Nat-Gas UNG, Daily

As of this post (10:45 a.m., EST), UNG has penetrated support and is trading in a narrow range.

Breaking below support (blue line) puts UNG, in Wyckoff Spring Position, ready for potential reversal.

Note the heavy down volume (purple oval) with little net downside progress.

Positioning

Could UNG post lower? Certainly, anything can happen.

Have the longs been washed out?

Volume, price action and time say, if it has not happened already, we may be close.

An initial long position has been opened at UNG 6.34, with tentative stop at the session low, currently, UNG 6.29 (not advice, not a recommendation).

Trade is identified at UNG-23-05.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Nat-Gas & Real Estate « The Danger Point®