Who’s left To Buy?

The massive, $21-Billion inflow to the S&P tracking fund SPY, may be signaling a historic ‘changing of hands’, indicating bulls are exhausted.

The coming days and weeks will reveal if that was indeed, the top.

Let’s not forget, if we’re rotating lower from here, the highs were posted during a holiday week, just before Christmas.

Holiday Turns

Markets tend to reverse just before, during, or just after a holiday week. Reference these links for ‘Holiday Turns’.

Bearish Divergences Everywhere

All over the market landscape, we have bearish MACD divergences in multiple timeframes; Monthly, Weekly and Daily … even on some 4-Hour charts.

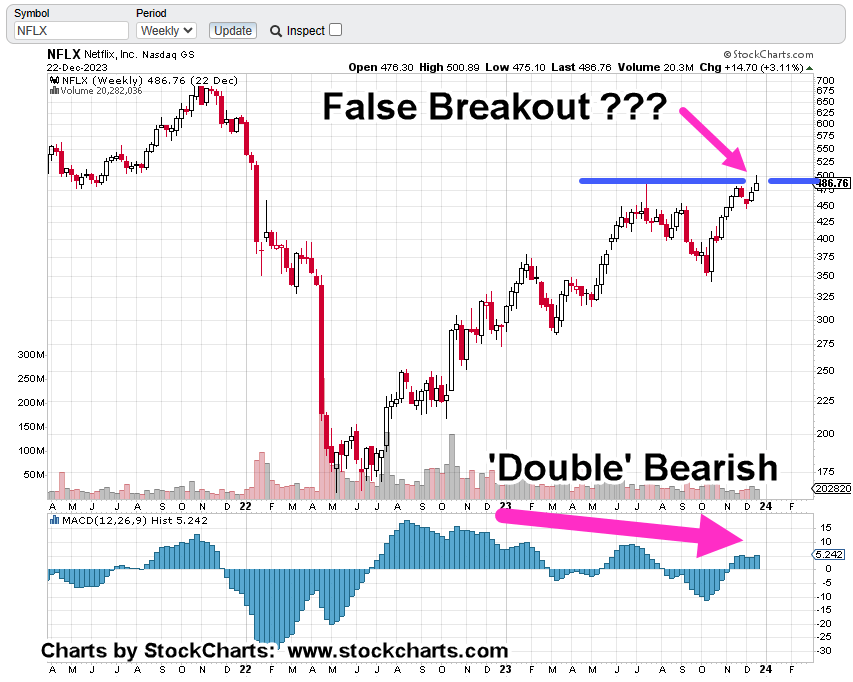

With that in mind, let’s look at just one example: Netflix.

Netflix NFLX, Weekly

Be reminded, the U.S. consumer is maxed-out; they’re (likely) finished from a continuing spending perspective. Credit card balances at all-time highs.

With food prices pressing upward and availability a problem, one has to think, ‘You can’t eat Netflix’.

We have a ‘double’ bearish divergence. The daily chart (not shown) has a bearish divergence as well.

In addition, last Friday’s price action on the daily was ‘outside-down’, or ‘bearish engulfing candle’.

Premium or Discount

Using veteran trader Richie Naso’s terminology (see last post), is NFLX at a premium or discount?

Is price action set up to reverse or continue higher?

It’s likely we’re about to find out, starting tomorrow.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279