Any Bulls Left?

It’s all bearish on the Nat-gas front.

Way back in 2001, it was all bearish on the gold front as well; lows were around $254/oz. – $255/oz.

How did that work out?

No, Nat-gas is not gold but at this point, it’s possibly just as ignored as gold was, then.

The strategy or potential reasons for a rally in Nat-gas, have already been addressed here and here.

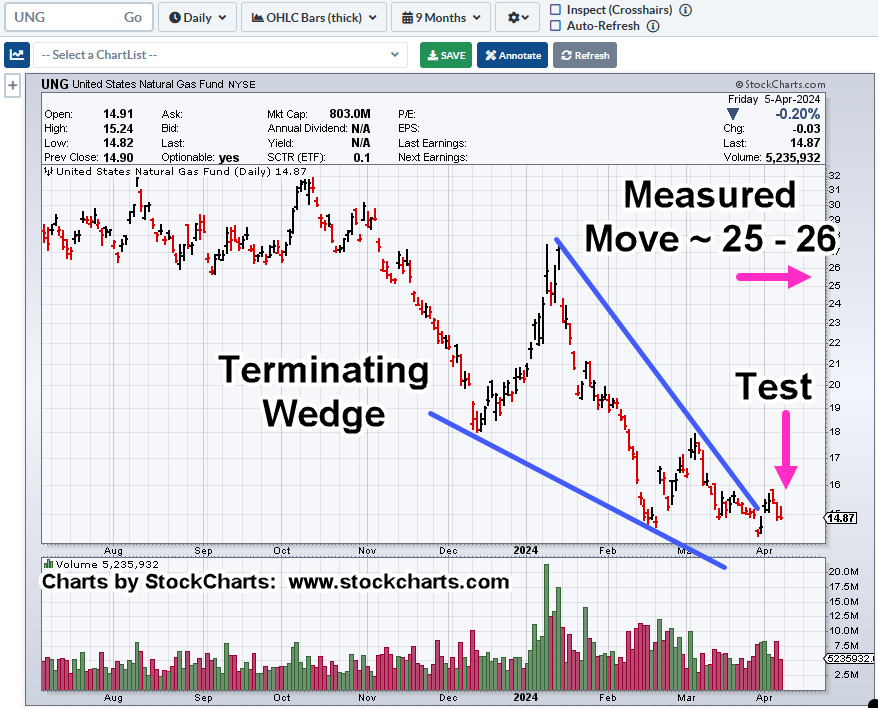

So, we’ll cut to the chase, looking at the proxy, UNG.

Natural Gas, UNG, Daily

It’s possible, the March 27th, penetration of support (covered here) and subsequent recovery, is a Wyckoff spring set-up (not advice, not a recommendation).

If we’re in a spring with the wedge in-effect, meaning, the market’s not going to morph into another structure, then it’s likely, Friday’s action was a test of both the spring and the wedge (breakout).

Supporting the ‘test’ scenario, we have Friday’s action pulling back to the lows; volume contracts by over 37%, when compared to the day prior, Thursday.

Of course, this is all very nuanced action and can be blown away at the next session.

However, as with our gold example, no one was looking for a major, long-term reversal at the time.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279