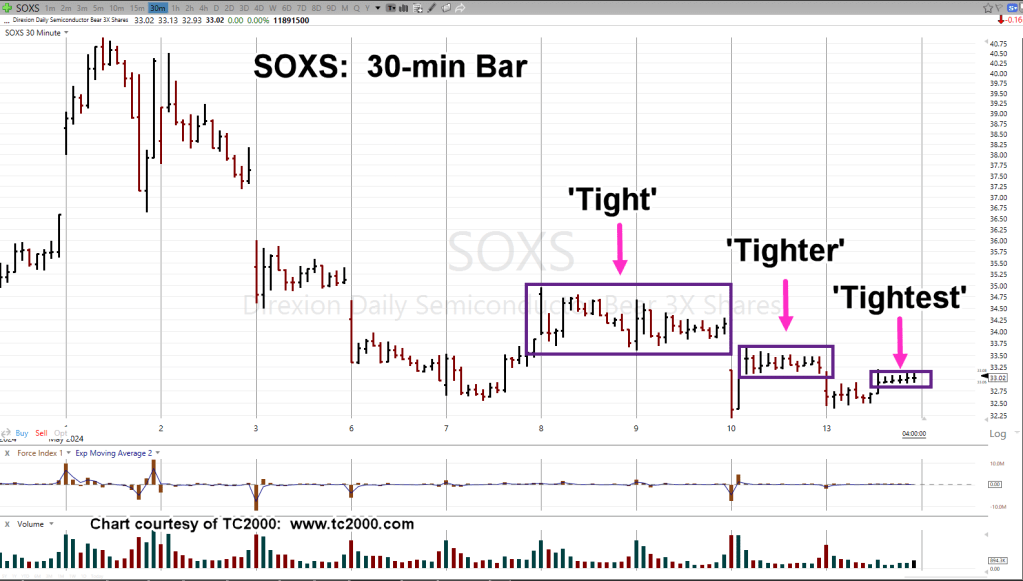

Was Today, The ‘Tightest’?

The last update on the SOXX (using inverse SOXS), said we closed out the day, last Friday, with five-hourly bars of tight price action.

Tight action implies a directional, breakout move of some sort; expecting downward, for the SOXX (not advice, not a recommendation).

It didn’t happen.

What we got instead, shown below, is price action that’s even tighter.

Since the last update used the 3X Leveraged Inverse Fund SOXS, we’ll continue with that, but move to a 30-minute timeframe.

Semiconductors 3X Leveraged Inverse SOXS, 30-minute

The boxes outline price action that has become increasingly more and more constricted.

Obviously, something’s about to happen … but what?

Data Release

Tomorrow’s the release of PPI data along with a couple of Fed speeches.

Not that the ‘data’ really matters. Anyone with two basis points rubbing together should already know about accuracy of ‘the data’.

Even so, it can be used as an excuse for market manipulation.

So, let’s see what happens next.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279