Of Course, Not

The Fed’s not about to tell anyone, what they (really) do, is follow the bond market.

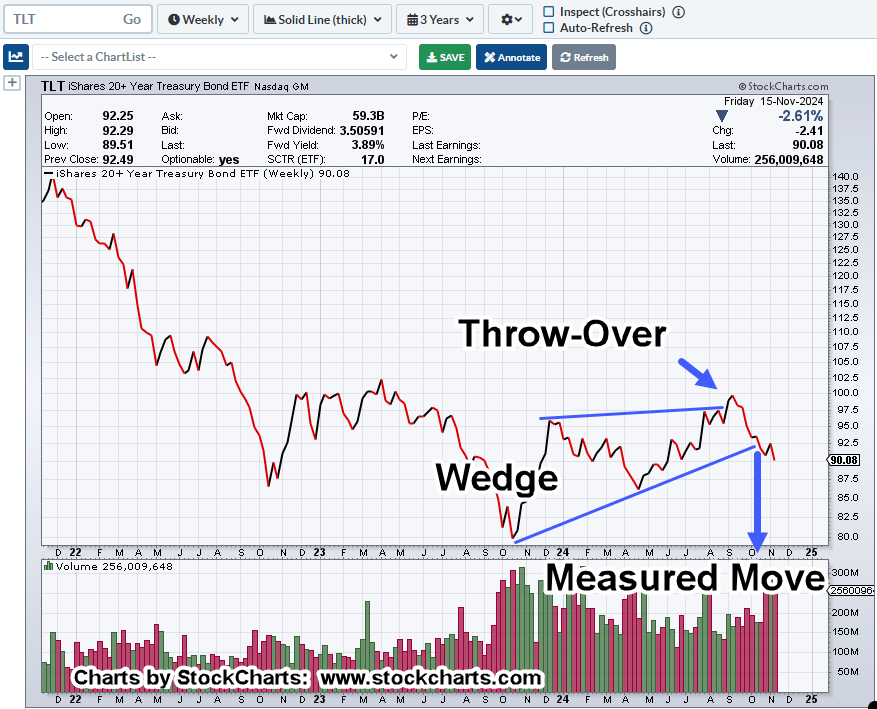

When looking at ETF proxy for long bonds, TLT (below), one could infer, by late January, Fed rates may start going back up (not advice, not a recommendation).

Since we’ve entered a time where long secret (or obscured) truths are now revealed, it might just be, the public discovers (en masse) the emperor has no clothes.

Steve Poplar at ‘The Poplar Report’ has it figured out (time stamp 12:00, link here).

With that, let’s look at the bond market and see what it’s saying about itself.

Long Bonds, TLT, Weekly Close

Price action appears to be breaking down out of a wedge.

The potential?

Higher interest rates going into year-end (not advice, not a recommendation).

The result: fewer autos sold/financed, fewer homes sold/financed and possibly much less spending on Christmas.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279