Short(s) Hanging On … Tight

Everyone seems to think, January 20th (if we ever get there), is going to bring a new era of ‘prosperity’.

We even have a hot-off-the-press, jobs number, magically appear to bolster the case (not advice, not a recommendation).

Price Action … Truth

The crux of Wyckoff analysis, proposed over a century ago, is that we’re to completely ignore the financial press.

The focus is to be on the action itself.

Doing that, identified a potential opportunity; Russell 2000 (IWM), presented as a possible short candidate (not advice, not a recommendation).

Since that update (as of 11:13 a.m., EST), IWM is down near -4%, leveraged inverse fund TZA, up about +13%.

Possibly more important as we’ll see below, are the trendlines and channel(s).

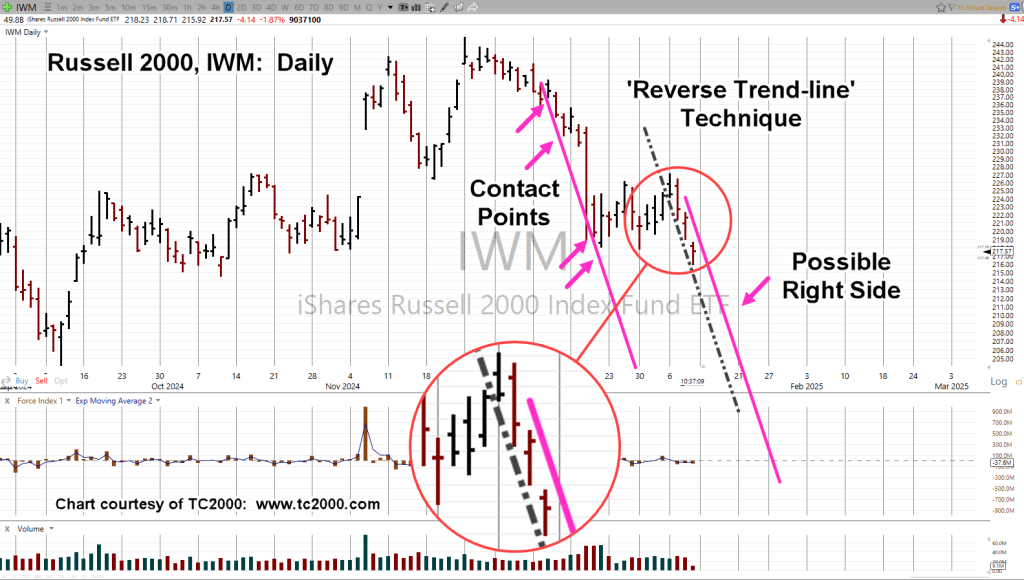

Russell 2000 ETF, IWM, Daily

The grey (dashed) trendline has verified contact points on January 6th, 7th, 8th and today, the 10th.

The ‘reverse trendline’ technique is being used to identify the potential right side.

Reverse trendline, discussed in the David Weis training video, link here.

What’s Next?

The short answer is, it’s not known.

However, the probability is, for action to continue in the direction already established … that is, down (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279