At The End of The Move

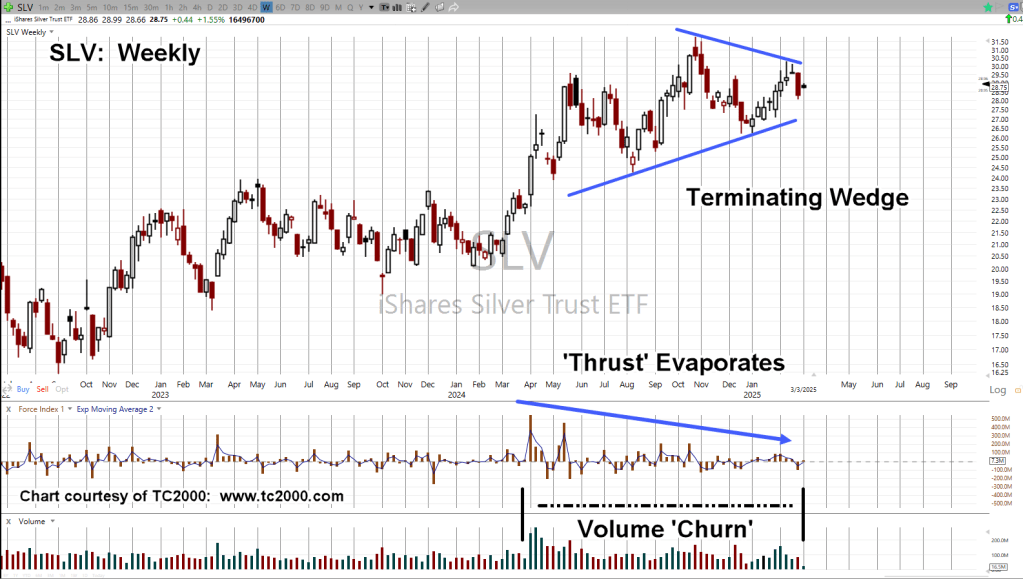

A ‘terminating’ wedge, typically comes at the end of a move whether up or down.

In the case of silver (SLV), that wedge has formed during an up move, giving us a hint, the next significant direction may be down (not advice, not a recommendation).

Silver SLV, Weekly

There’s a lot going on in this chart.

We’re coming up on the one-year anniversary of the hyperinflation breakout hysteria; remember that?

An entire series of posts was created on silver SLV, to show that for one, it’s not in a hyperinflation breakout, and two, historic price action suggests SLV projects to either a downside reversal, or sideways congestion (not advice, not a recommendation).

In about one year, SLV moved from $24.49, to yesterday’s $28.75; hardly a launch to $100/oz. – $500/oz., or more.

The Caveat

An SLV, post above last week’s high of 29.61, is a potential negation of the above analysis.

With that said, the wedge appears to be in-effect for now.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279