Repeating Pattern

During the last multi-year, market melt-down from ’07 – ’09, Cadence Design Systems (CDNS) crashed over -90%, in a relatively ‘well-behaved’ collapse.

‘Well-behaved’; straight down, sideways, then straight down again.

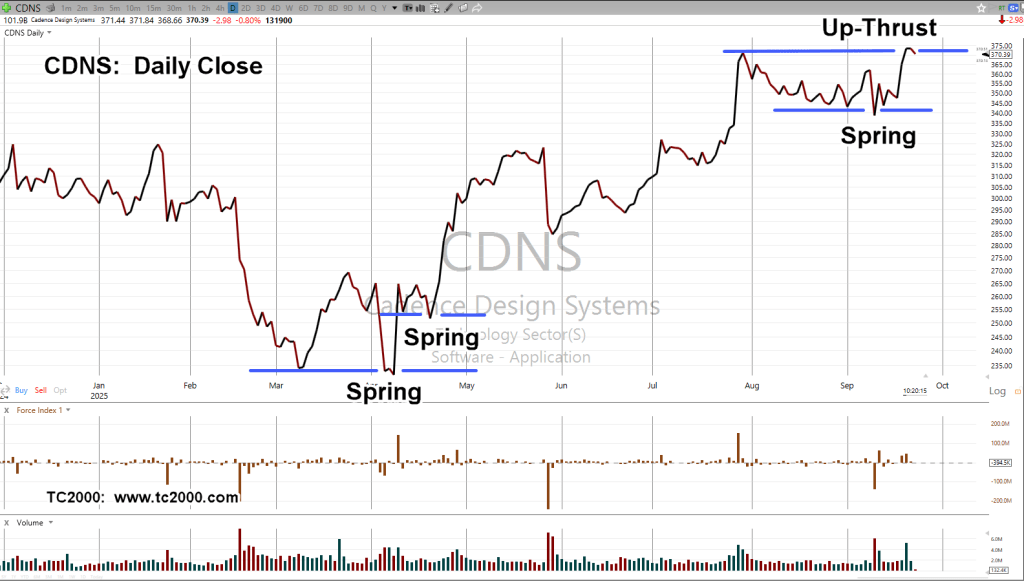

Looking at the current price action on a closing basis, we see the ominous (potential) pattern of Spring-to-Up-Thrust.

Cadence Design Systems, CDNS, Daily Close

Other Wyckoff ‘spring’ set-ups are noted.

However, this time around, we may be in up-thrust (reversal) condition.

The next earnings release is late October; there’s time to assess action (if/when short) before any Kabuki theater (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

This is one of those stocks that Weinstein is bullish on because it finished a year long consolidation and broke out. I’m still hesitant to buy though because it feels as though every Tom Dick and Harry are looking at stocks.

LikeLiked by 1 person

Thanks again,

Well, there you have it. Two sides of the coin.

The set-up for CDNS is just that, a set-up. A repeating pattern that my mentor (Weis) discussed years ago.

The point of today’s update is to highlight we’re at The Danger Point, where the risk is least, if wrong. At this time, I have no position but am watching closely to see if CDNS makes a new daily low. Right now, (1:03 p.m., EST), it has not.

As an example of how the set-up works, we have WMT. Yesterday’s post said to watch to see if volume contracted from the day prior. It did (by a lot) and so I went short (about one minute before the close) with a small position (not advice).

Today, WMT posted a new daily low. I increased the short (again, not advice) with a very tight stop at yesterday’s high.

Will CDNS do the same? Right now, the answer is no.

Again, I appreciate the input.

Best regards,

Paul

LikeLike

I had to comment because it’s one of those stocks I’ve been watching but nobody seems to talk about. BWXT is another one too that’s had a great run, but I feel like is under the radar. I guess it shouldn’t be a surprise, it’s all technology related and tech has been doing well.

The recent U-shape pattern in BWXT reminds me a little of a similar looking U-shape pattern in CVNA. Don’t you think?

And CDNS dripped lower all day today so looks like you’re onto something.

LikeLiked by 1 person

Once again, I appreciate the input.

CVNA is planned for update tomorrow unless something happens overnight. It has posted another up-thrust reversal pattern (to be discussed). I was waiting for a new daily low, which happened today. Small short position initiated with stop at the day’s high (not advice,).

As for Aerospace/Defense, (BWXT), I stay away but that’s just my personal preference. In my opinion the whole world-wide situation is so fluid, anything can happen. I would rather focus on areas like the U.S. consumer (who, for the most part, is broke) and go that direction.

CDNS did post a new daily low, but I did not go short. The reason for choosing CVNA over CDNS for now, was the volume. Volume on CDNS was not all that heavy while for CVNA, as price headed lower, volume increased.

Of course, that nuance in volume does not guarantee anything, but I thought it might be of some importance.

Thaks again,

Paul

LikeLiked by 1 person

Pingback: Carvana … Falls in Hole « The Danger Point®