Dip, or Squeeze?

Spotify’s earnings release, coincided with a (supposedly) massive ‘retail’ buying spree, link here.

The article says it’s retail causing the launch; comment’s section, says otherwise.

From a Wyckoff analysis perspective, it doesn’t matter who’s doing the buying or why.

What matters, is what the market is saying about itself.

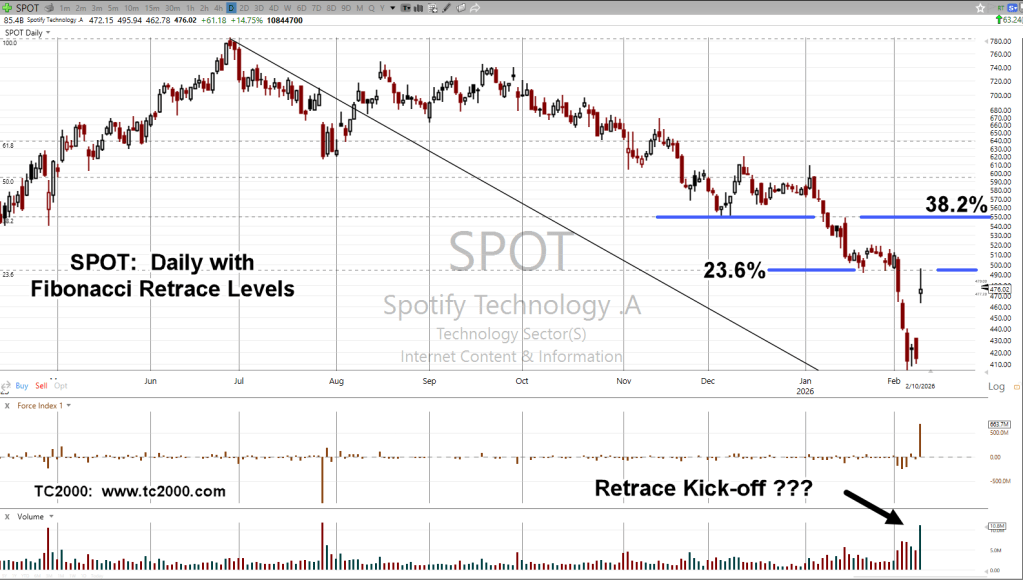

Spotify SPOT, Daily

As this link says, there’s not much sold short … less than 3% of float.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

I saw a chart somewhere of short interest on the major indices, and short interest is pretty much at all time lows. Which gives me hope that short selling can work again as a strategy. Still, it’s been rough sledding for shorts.

LikeLiked by 1 person

Thanks for the update.

When I looked up short interest on SPOT, I’ll admit, I was shocked. I expected to see something like 20% – 30% short.

The Rydex indicator on Bull/Bear holds a good correlation of when the market is ready to turn (in either direction). https://thedangerpoint.com/2026/01/16/rydex-bull-bear/

So, from a strategic standpoint, with the Rydex at low extremes, it would seem the odds are against further significant upside.

Yes, it’s a tough situation for the shorts. I’m looking at it as an opportunity to further hone the skill.

For example, so far this year, I’ve attempted to short TXN three times. TXN-26-03, is still active and price action has not revisited that entry level. So, the position is being maintained.

Depending on tomorrow, I might have to exit or move the stop lower to today’s high (not advice).

At these extreme levels, it might take a while for price action to fully get going to the downside. BKNG is an excellent example.

It wandered around the interim highs from mid-December to early January before imploding.

From a personal standpoint, I’d rather attempt several entries than wake up one morning and find the market has collapsed (without me on board).

I appreciate the input.

Regards,

Paul

LikeLiked by 1 person