It’s possible during the last session gold (GLD) received a final mortal wound to the hyperinflation argument.

Price action in the December contract (GCZ20) dropped over 100 points in a matter of hours.

A retrace is expected … it’s just part of market behavior.

However, even as gold edges higher, the Junior Miner’s, don’t seem too eager to follow suit.

Price action in GDXJ has risen just slightly with JDST down 0.50% in pre-market.

The dollar (UUP) has reversed as expected. It’s got a long way to go higher for any kind of test on wide, high volume action. Dollar higher, gold typically, lower.

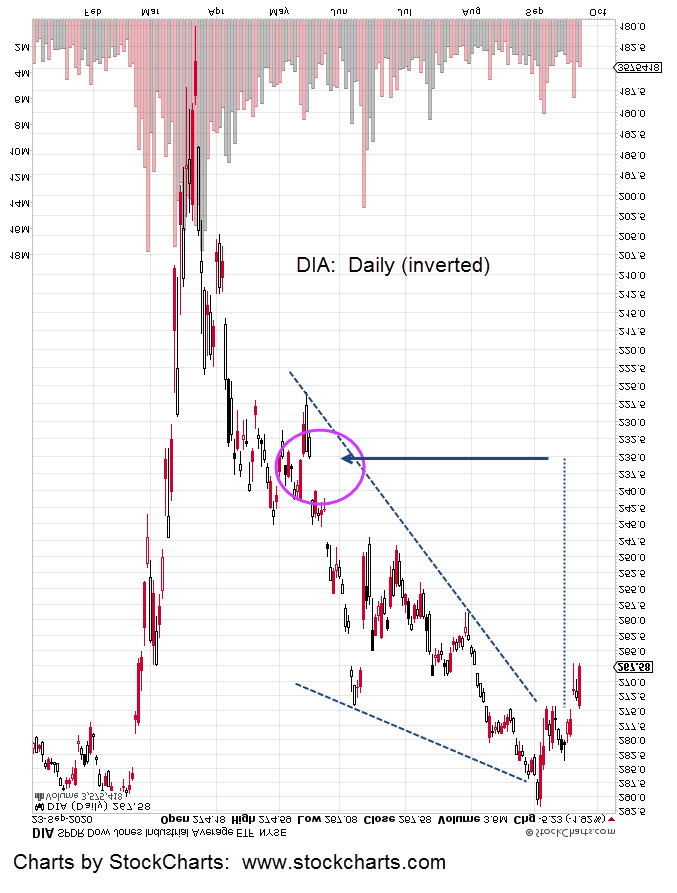

The short position in the Dow (DXD) has retraced somewhat in the early hours.

As it stands now, the retrace is about 1/3rd of the overall gain thus far; perfectly acceptable.

The focus for the firm’s trading at this point is on the Dow and related markets. If the position is increased at these levels (and the analysis proves to be incorrect), it could be stopped out the same day.

So we’ll wait to add … for now.

Separately, it should be noted that every single market assessment in the previous update was correct:

GDXJ in up-thrust reversal condition … check

GDXJ finished at high on Friday, Monday’s typically down … check

Gold retraced to 50%, lower price action expected … check

Dollar in its own reversal set-up … check

Dollar up, gold down … check

All that list means, is at this juncture the markets are being correctly interpreted.

Those interpretations are being done intuitively and without indicators.

Intuition can be skewed by events unrelated to the markets. For now, it’s operating correctly and we’re going to focus on the Dow.