Below Resistance

When the upside comes to a halt, it’s the ‘evil manipulator’s’ fault.

At least, that’s the common lament from our friends and pundits, alike. 🙂

Just a reminder, the markets have always been manipulated.

Back in the day, Wyckoff understood this. He sought to find out through price action, the desired (market) outcome of those ‘manipulators’.

By using his technique and reading the tape, the most probable direction for silver (SLV) was either sideways congestion or downside reversal.

The last update, link here, had this to say:

“If we’re in an up-thrust about, to reverse lower or consolidate, this is the type of market behavior to expect (not advice, not a recommendation).”

From then, we see SLV has moved lower.

Silver SLV, Weekly

Can reversals themselves, be reversed?

Could SLV, somehow gain traction and move decidedly higher? As David Weis used to say, “Anything can happen”.

However, at this juncture, we have SLV closing lower the past two weeks. Volume was steady and elevated, indicating downside pressure.

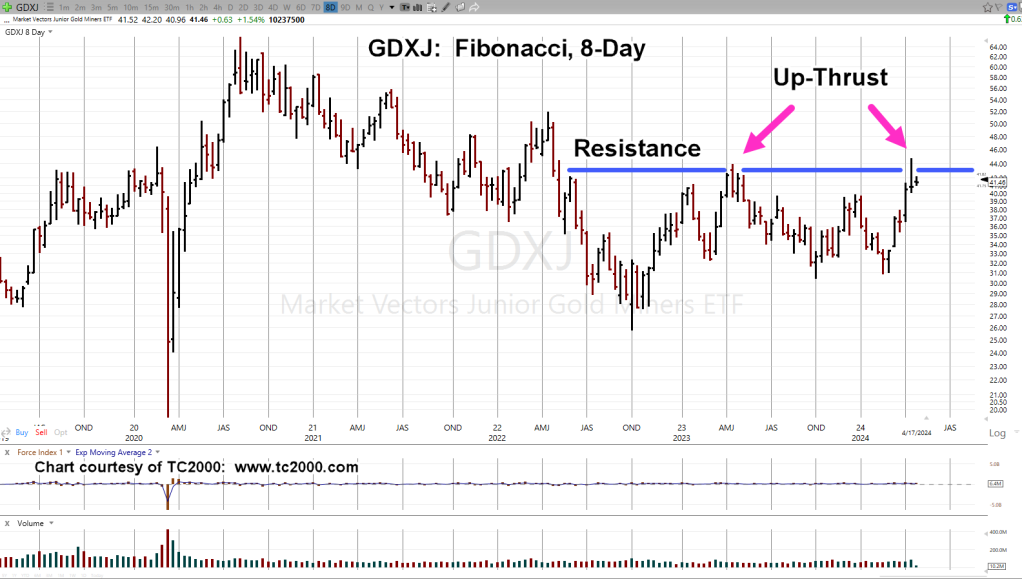

Separately, the miners are struggling (especially the Juniors GDXJ) at resistance.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279