Ignored, by ‘Mr. Big’

The latest out from ZeroHedge, says that Michael Burry (a.k.a., The Big Short), while claiming Tesla is overvalued (current P/E, 271), does not have a short position.

Adding to the ‘overvaluation’ theme, is deterioration in sales that’s now entering its second year; here and here. Yet, TSLA just made all-time highs this past December 22nd.

In a nutshell, this is the problem with ‘fundamentals’.

Meaning, as far as assessing price action probability, they’re not useful and never have been (not advice, not a recommendation).

A good example of that premise is CrowdStrike (CRWD); with its current P/E, at minus 428. That’s a negative.

When their P/E, is positive, which is not often, we get numbers like 786; yet, the closing price (yesterday) for CRWD was 468.76, with a market cap of 119.4 billion.

How does that even work?

Possibly more entertaining from the ZeroHedge link, are the comments. All kinds of reasons not to short Tesla.

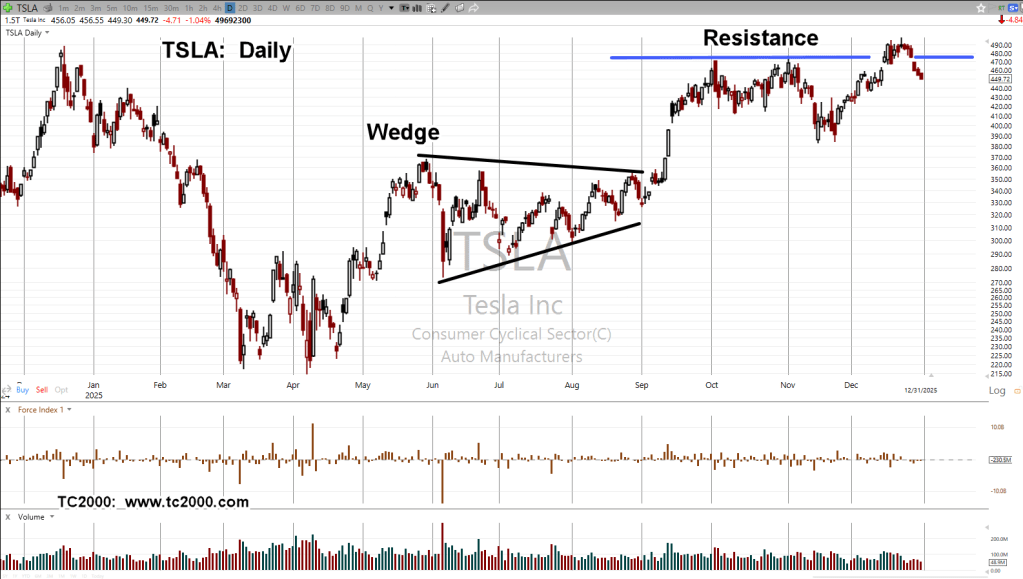

Tesla TSA, Daily

What do you see?

TSLA printed an all-time high on an attempted breakout that has so far, fallen below resistance.

On the sell side, is of course, to short TSLA directly.

Not wanting to be completely exposed to any untoward action, one can short Consumer Discretionary XLY, and effectively short AMZN as well (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279