Decisive Rejection

Is the bottom about to fall out?

The last update on the Junior Gold Miners GDXJ, said they were hanging by a thread.

That update even included a forecast which turned out to be wrong and right at the same time (not advice, not a recommendation).

The miners have reversed … it just did not happen the next day as shown on the forecast chart.

The decisive rejection of the resistance (and test) level happened four days later.

Today, continued a slight retrace of that down-move as shown on the daily close chart below.

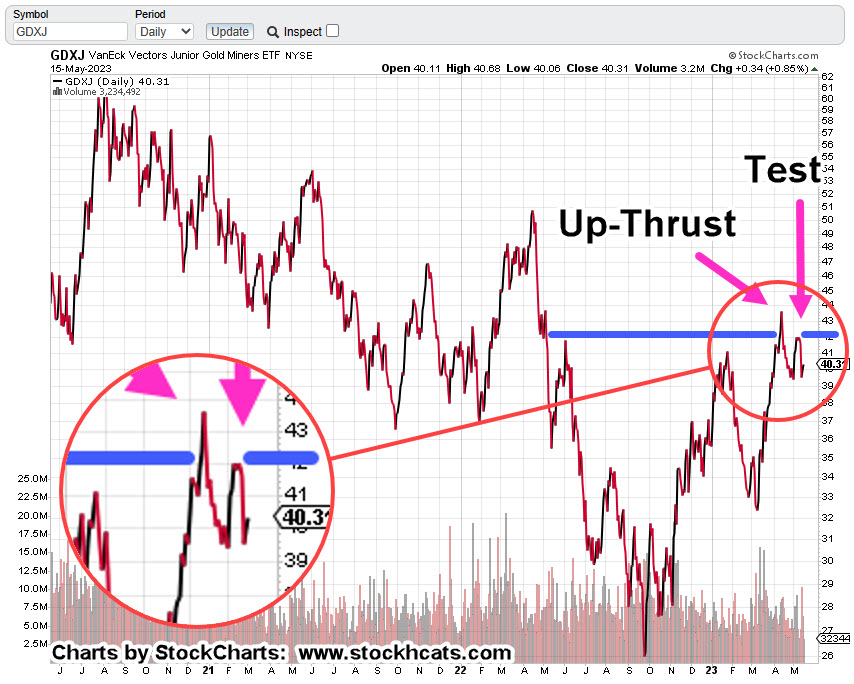

Junior Miners GDXJ, Daily Close

The attempt to push above known resistance (blue line) has failed. Price action had a false breakout (Wyckoff Up-Thrust), then a test and subsequent failure of that test.

The zoom of the reversal area shows more detail.

Last Friday’s session closed higher as did today … however today’s volume (i.e., commitment) was down – 49.4% when compared to the prior session.

The buyers are pulling back … price action is drifting higher.

On a weekly basis, we still have a bearish MACD divergence (not shown). Probabilities at this point indicate lower prices ahead (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Miner’s Reversal … Still Early « The Danger Point®

Pingback: Kabuki ‘Debt Ceiling’, & Gold « The Danger Point®

Pingback: Kabuki ‘Debt Ceiling’, & Gold — The Danger Point® – The Fourth Estate

Pingback: Gold Miners … Too Late To Short ? « The Danger Point®