Two Years Later

The on-going short position via SOXS has been maintained (with a new stop) and here’s why.

Just over two years ago was this post.

There are certain behaviors that markets tend to repeat; what’s called a Wyckoff ‘spring to up thrust’, is one of those.

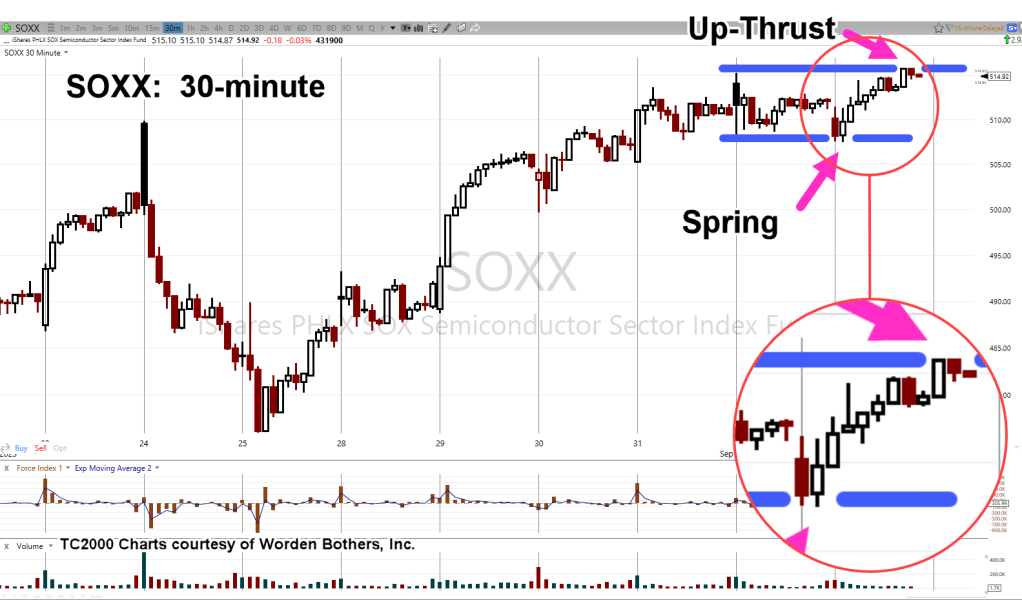

Looking at the 30-minute chart of SOXX, that’s what we have today, … just barely.

What happened this session in the SOXX may be the last move upward before a sustained reversal.

Semiconductor SOXX, 30-minute

This morning, the SOXX penetrates prior 30-minute lows and sets-up a minor ‘spring’.

Price action then moves higher to just barely exceed the prior session highs for the ‘up-thrust’.

Then we have a retreat in the SOXX, effectively confirming that what just happened was a Wyckoff spring to up-thrust.

This is where sustainable reversals tend to occur.

Positioning

The previous Hard Stop of SOXS 8.97, is adjusted by two ticks to 8.95 (not advice, not a recommendation).

Obviously, the expectation is for a SOXX downside (SOXS higher) reversal from this point.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Has AI, Started To Crack? « The Danger Point®