The ‘Uh Oh’ Moment

Now it begins, sowing the seeds of doubt.

‘First rate cut may be later than expected.’

How about be prepared for no rate cuts this year and more likely, continued elevated rates or higher rates (not advice, not a recommendation).

Let’s not forget we’re over a year now from the release of this post, postulating there would be no ‘Fed pivot’.

So far, no pivot and no cut.

Now that nearly everyone’s positioned on the ‘rate cut’ side, it’s time for the shakedown, possibly beginning today.

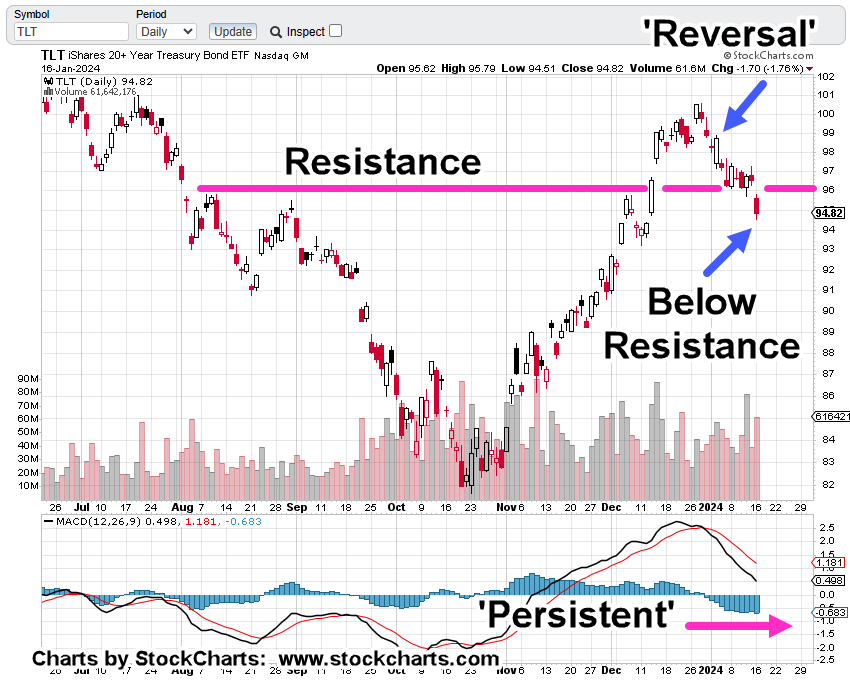

Long Bonds TLT, Daily

Just over two-weeks ago, this post noted to be on the watch for a failed breakout.

Looking at the result, we’re now below the prior breakout resistance, a bearish sign.

The chart of bonds itself is telling us (unless it’s reversed to the upside), there’s an increased chance rates are more likely to move higher (not advice, not a recommendation).

Note the ‘persistence’ to the downside of the MACD indicator. This tends to happen when sustained pressure is being applied … selling pressure in this case.

Stay Tuned

Charts by StockCharts

Pingback: Rates Rising … Miners Critical « The Danger Point®

Pingback: Potential Short: D.R. Horton « The Danger Point®