Watch For Retrace

We’ve all heard, it’s 80% planning and 20% trading.

So it is, with D.R. Horton (DHI).

As a reminder, this site addresses strategic positioning first, then tactics, and then focus. See the About section for more.

Strategy Review

Unless the charts say otherwise, rates are going higher, not lower. Gold and silver will likely go lower first, before going higher, supply destruction and resulting price increases will continue (not advice, not a recommendation).

D.R. Horton: Possible Retrace

One of two scenarios are likely.

DHI could continue its decline, straightaway. Monday’s open could be gap-down, posting down, no looking back.

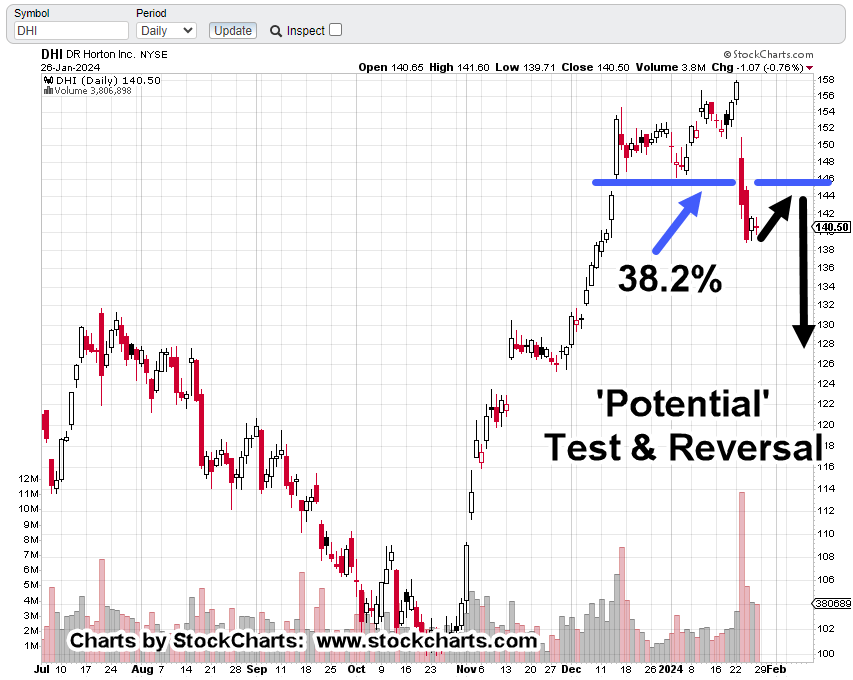

The next scenario, a retrace to test underside of resistance. As the chart below shows, that underside is right at 38.2%.

DHI, Daily

The chart presents ‘potential’ only. If the market is well behaved, a retrace to test is a reasonable expectation.

If there’s a retrace, Fibonacci Day 8, from the 1/22/24, high is this coming Wednesday, the 31st.

That day just so happens to correlate with the Fed interest rate announcement due out at 2:00 p.m., EST.

Stay Tuned

Charts by StockCharts

Pingback: Biotech “Bottled Air” « The Danger Point®

Pingback: DHI Bounce … Will It Hold? « The Danger Point®

Pingback: D.R. Horton ‘Rolls Over’ « The Danger Point®