A Strategic Bear Market

The gold/silver miners are breaking down, yet again.

The last update on GDXJ, link here, said to watch for a potential (bear market) reversal and upward correction.

We got the reversal, but it was weak, barely making it past a 23.6%, retrace before heading lower again.

Now, we’re in a ‘spot of bother’ as the Brits would say.

The Juniors are at the edge of a multi-year wedge formation, ready to break lower.

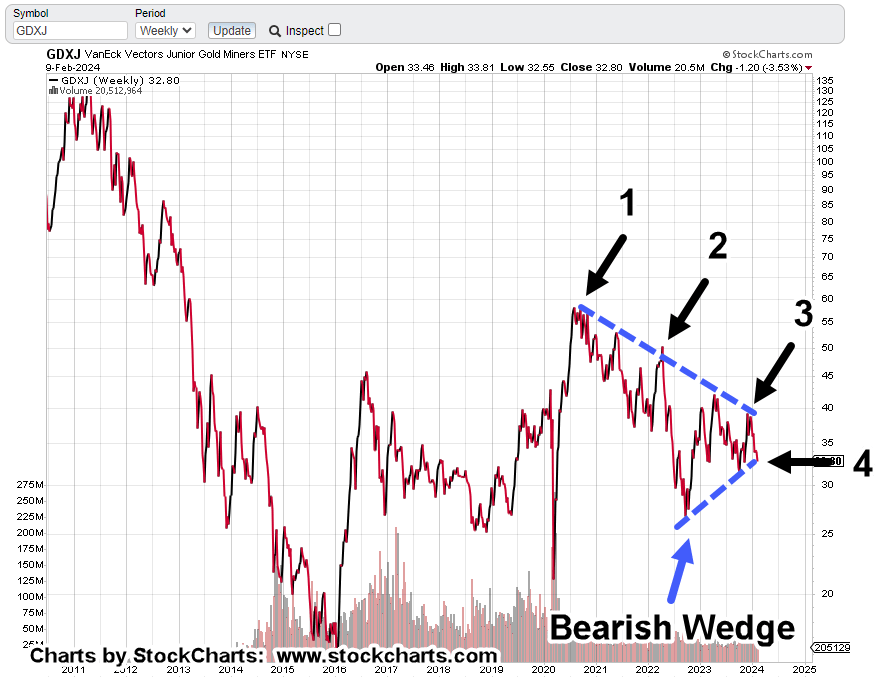

Junior Miners GDXJ, Weekly Close

The chart is long-term, locating strategic updates on GDXJ.

Note: Update No. 4, is this one 🙂

No. 1: ’What’s Wrong’, link here. No. 2: ’Timeline’s End’, link here. No. 3: ’Failed Breakout’, link here.

What’s Next?

At this juncture, the wedge boundary, anything can happen.

Typical vehicles for shorting the indices, GDX, GDXJ, are DUST, and JDST, respectively (not advice, not a recommendation).

If GDXJ, heads lower from here, we’ll discuss trendlines and a measured move in the next update.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: Miners Test The ‘Implosion’ « The Danger Point®

Pingback: D.R. Horton ‘Rolls Over’ « The Danger Point®