Setting Up For ‘Breakout’ or, ‘Digging-In’ …?

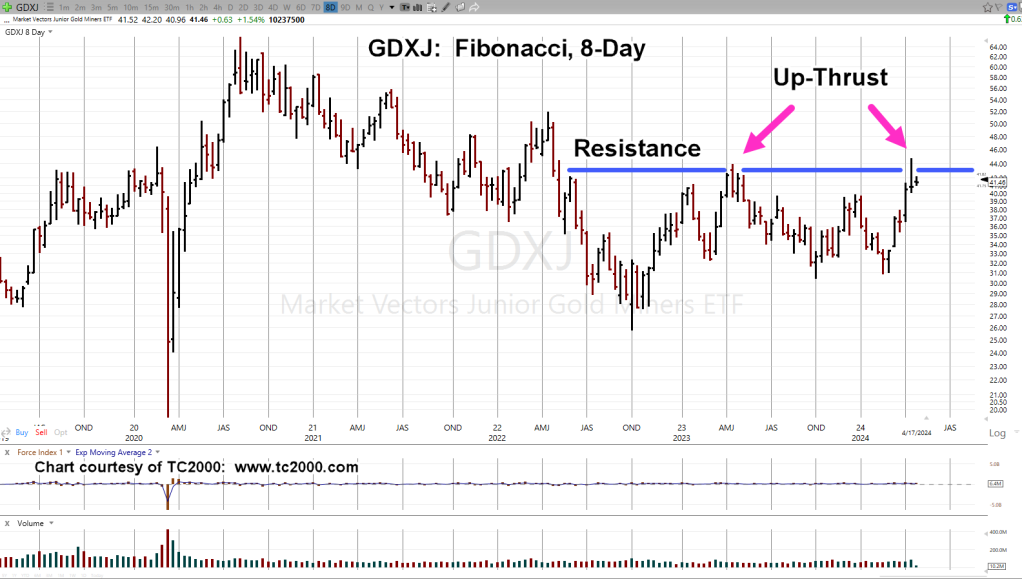

Gold’s near all-time highs, silver’s rebounded, testing recent highs; yet Newmont’s at a paltry 23.6%, retrace.

So, you tell me. What’s likely to happen to Newmont, if gold or silver head back lower, even just a little bit?

That dude in the picture, needs to keep on diggin’. 🙂

Wyckoff, In-The-Know

Years ago, Wyckoff told us not to pay any attention to the financial press, the local circus.

However, that does not mean he didn’t know what was going on. He did, and sometimes down to the penny.

We don’t know for sure what’s (really) happening with Newmont and the mining sector but among other things, it might have something to do with this, this, and this.

Even so, price action’s the truth; let’s look at our chief cook and bottle washer’s progress since the last update.

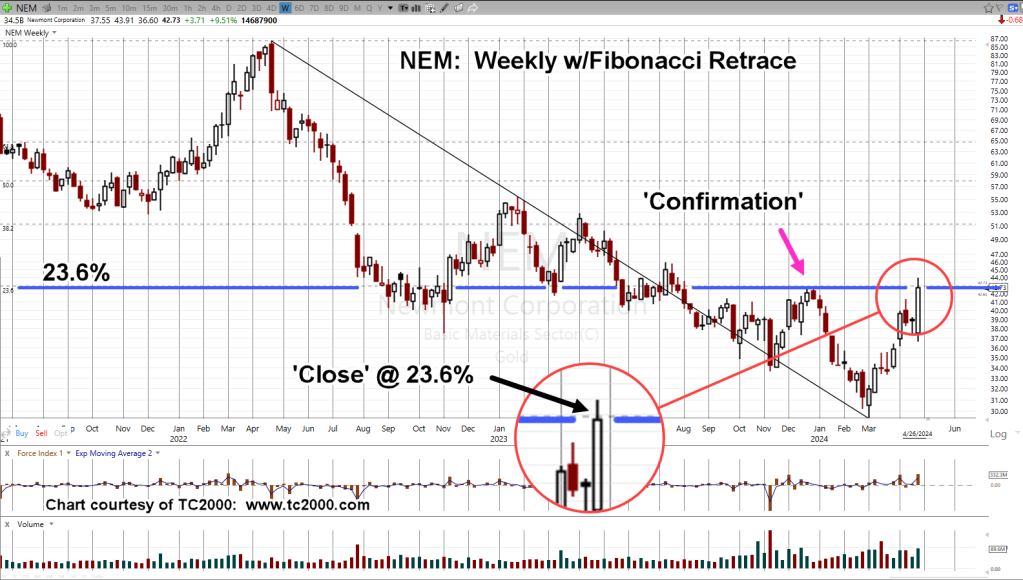

Newmont Mining NEM, Weekly

The chart has expanded the Force Index (middle panel) for better clarity.

Going back to the last update, it had this to say:

“A reasonable expectation is NEM, retraces, testing the wide bar and volume before continuing to the downside or moving back higher to a breakout.”

Price action has done exactly that. It came down to test the wide (4/25/24) bar and then back up to resistance, where we are now.

The only thing missing at this point, is the breakout or reversal (not advice, not a recommendation).

Show Me, The Money

Anyone with two Latte’s rubbing together, knows the economy may (already) be in full-blown collapse.

Anecdotal (and factual) evidence of that can be found here, here and here.

Adding, Nemont itself is not doing well as evidenced by this recent (February) article about dividend cuts, asset sales.

Seems like everybody’s looking around for cash.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279