New Daily Low

Biotech, a set-up whose time has come?

Can we go further to say, a ‘set-up’ within a ‘set-up’?

With the caveat that absolutely anything can happen, let’s look at what may be a competed test on the weekly time frame while at the same time, a completed up-thrust set-up on the daily time frame.

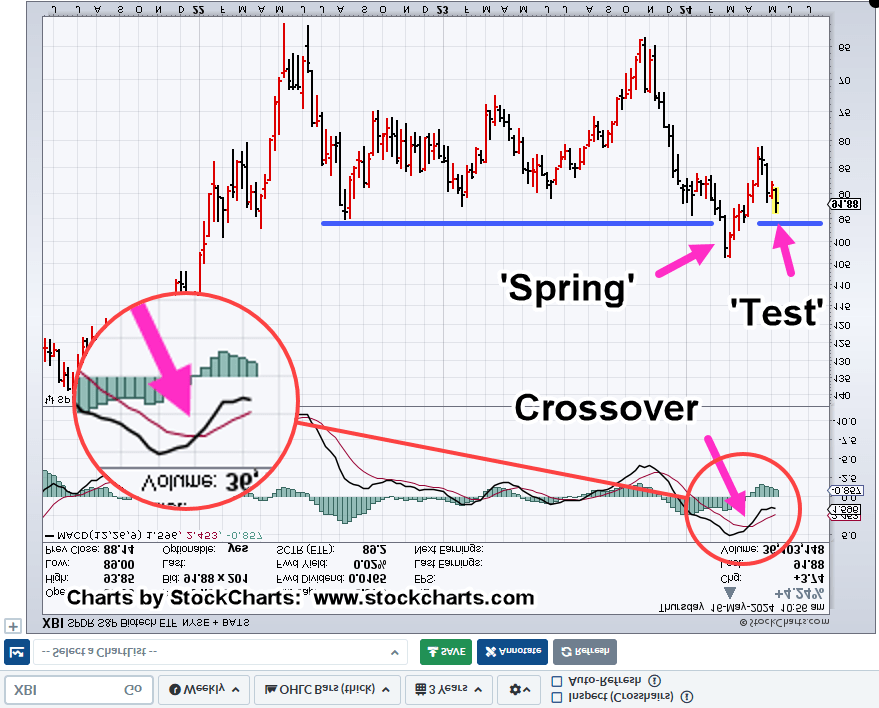

First, the weekly using the inverted chart.

Biotech XBI, Weekly (inverted)

As a reference, here’s the link to the prior weekly chart, discussing the spring ‘test’ set-up.

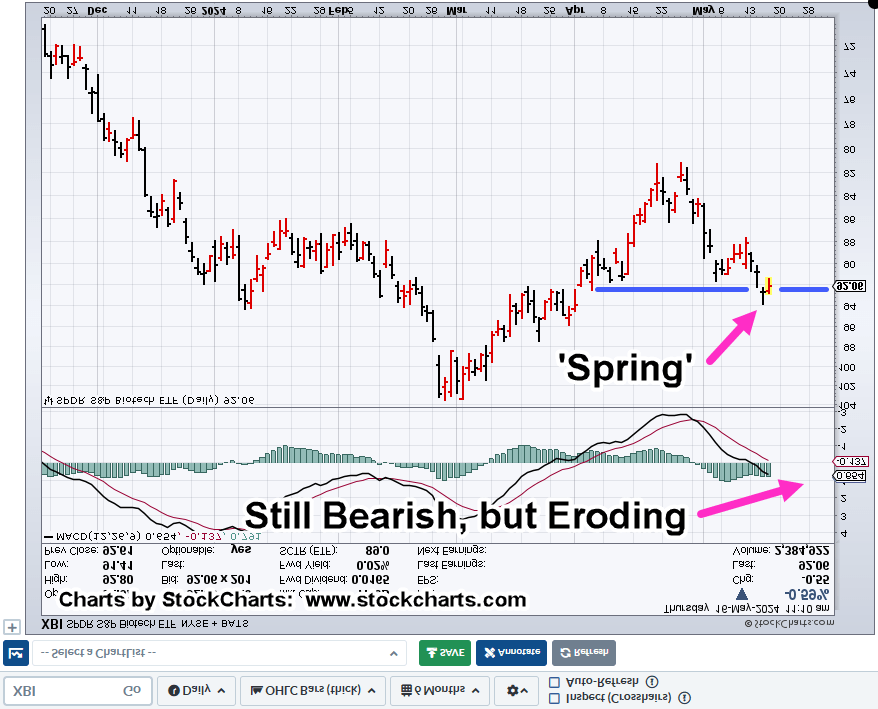

Moving on to the daily we have the following. Note, the daily has been inverted as well.

Biotech XBI, Daily (inverted)

From an MACD indicator standpoint, we’re still in bearish territory (bullish on the regular chart).

The entire trade set-up could evaporate.

So, there’s no doubt, we’re at The Danger Point®

From yesterday’s update the market itself has shown its stop level for a short position (not advice, not a recommendation).

Looking at the two charts, it’s possible to see a test of a spring on the larger weekly time frame which may itself have created a spring set-up on the daily timeframe: corresponding to up-thrust test, and up-thrust for non-inverted XBI.

Consider that this is all happening while the broader markets are making new all-time highs.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: The Bearish Bet on Biotech « The Danger Point®