On Target, On Time

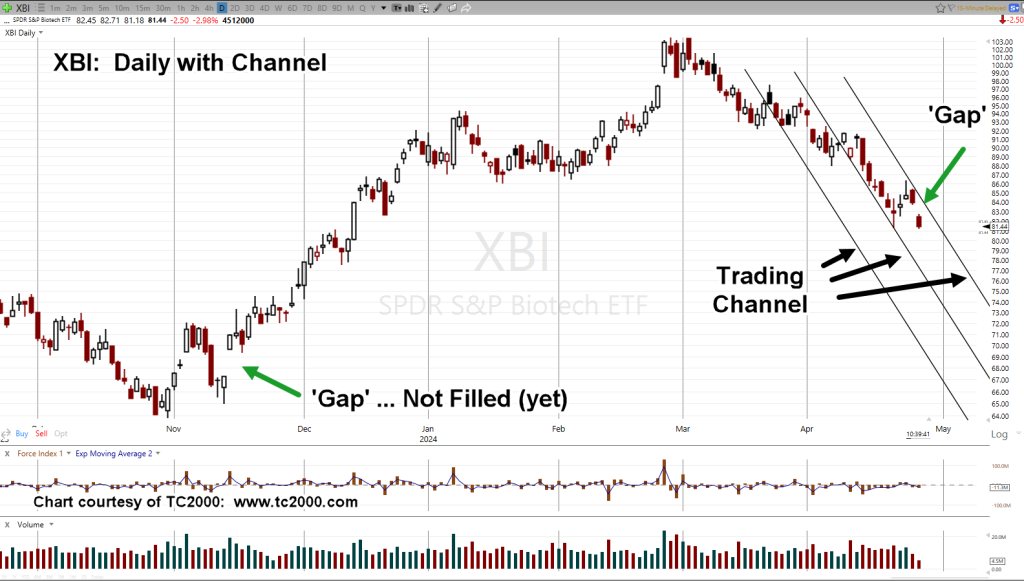

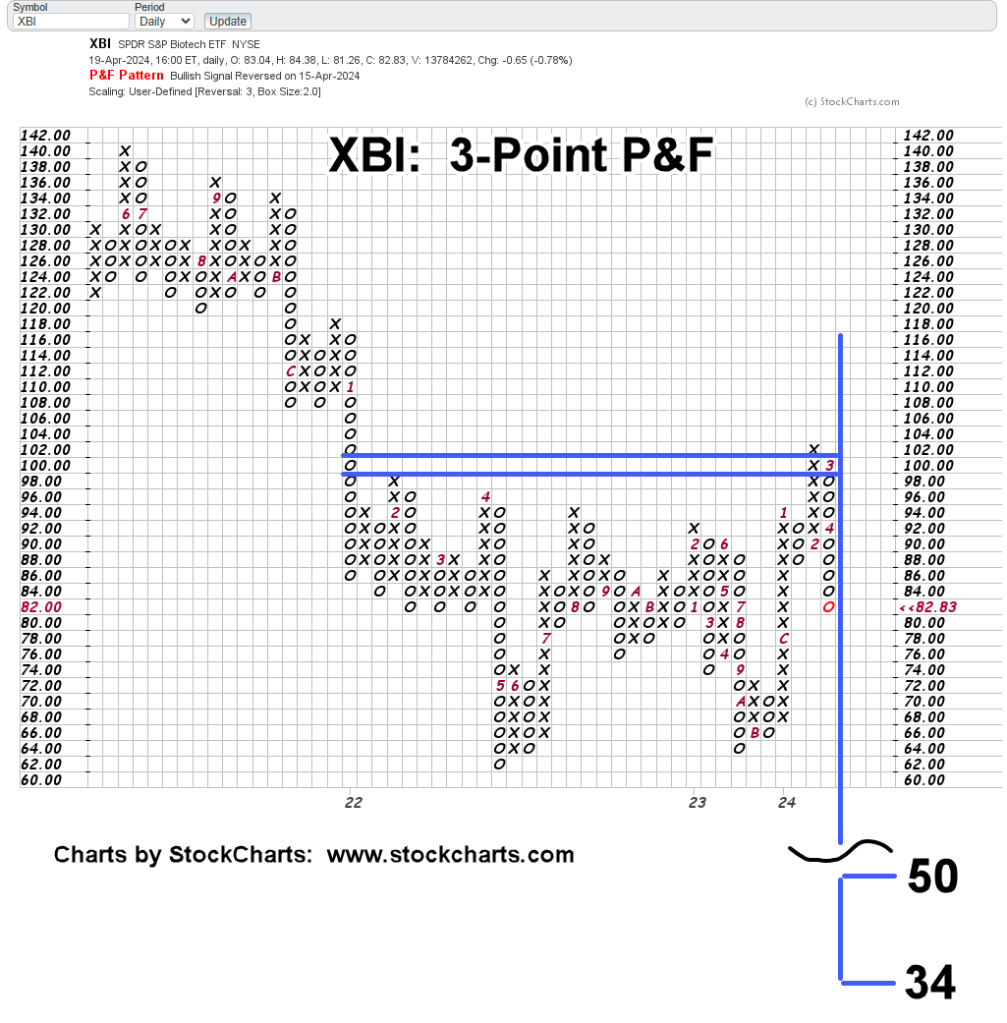

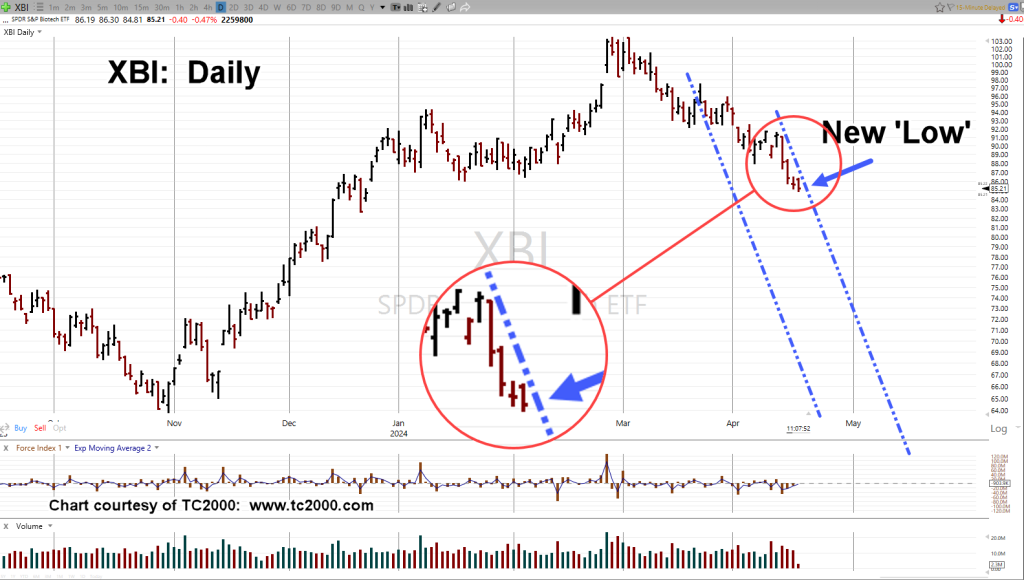

The last update on biotech XBI, ended with this:

“However, it’s just a sneaky suspicion, XBI may try to inch itself past the daily highs of April 9th, and April 11th (not advice, not a recommendation).”

Fast forward to now and here we are.

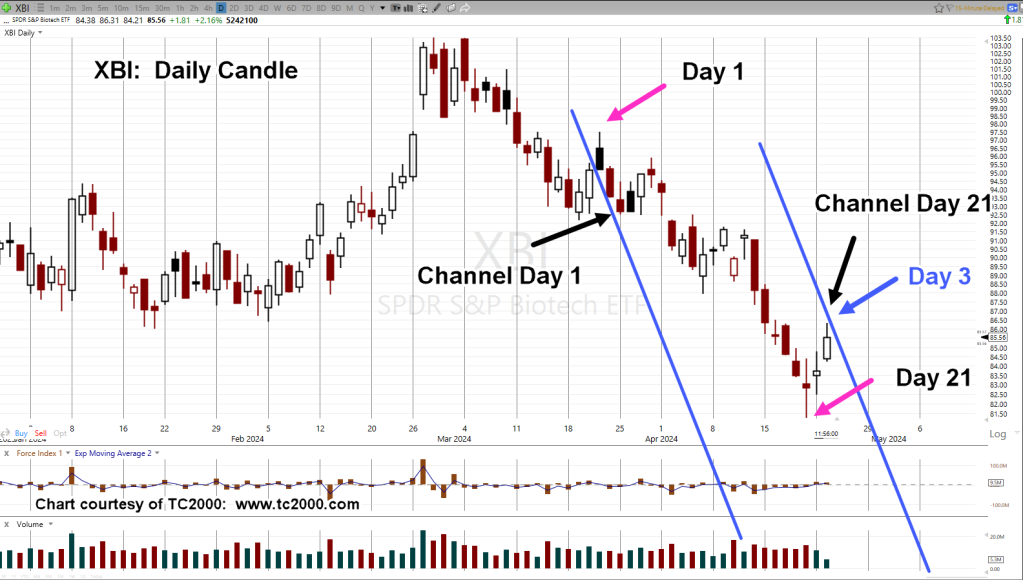

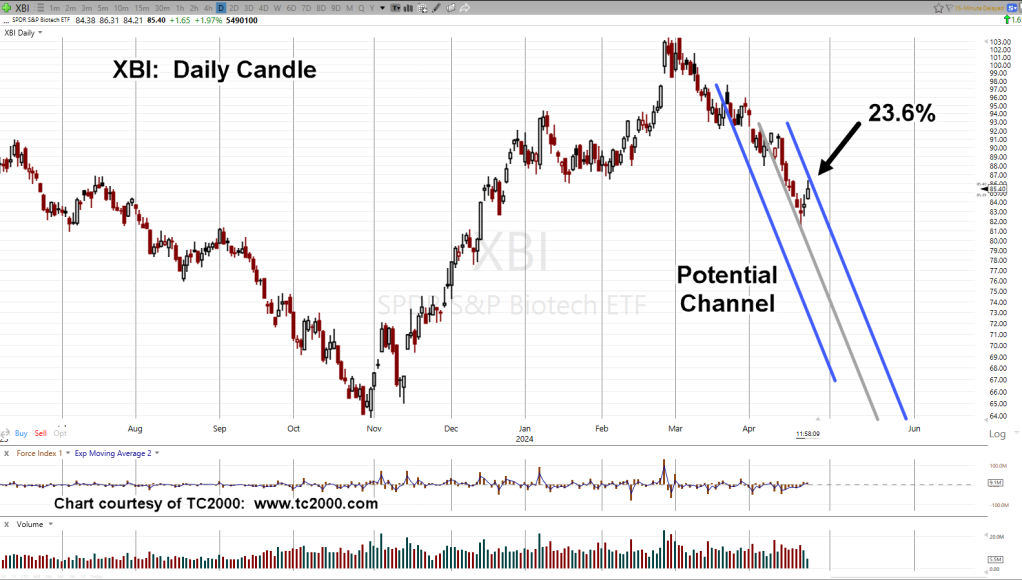

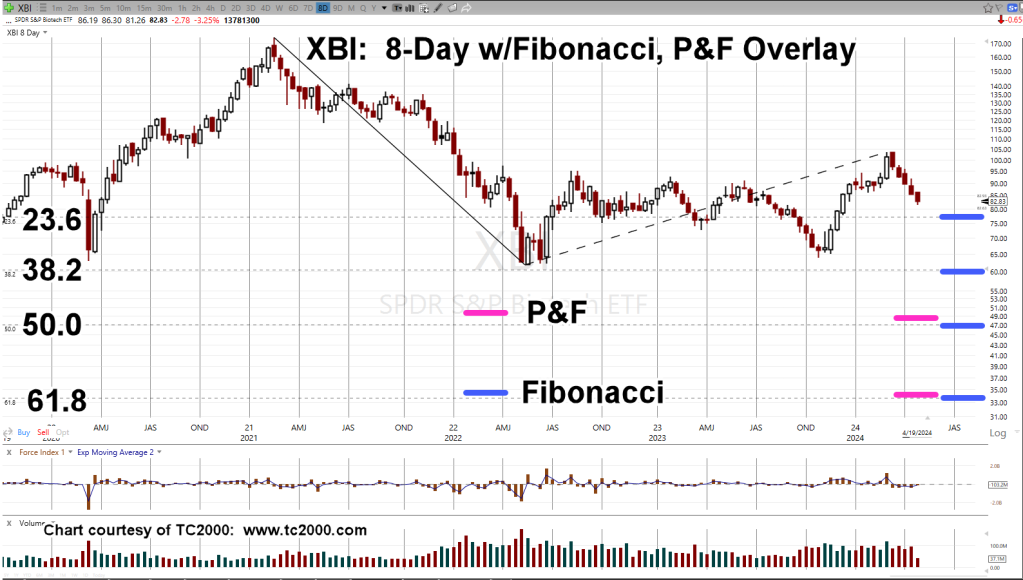

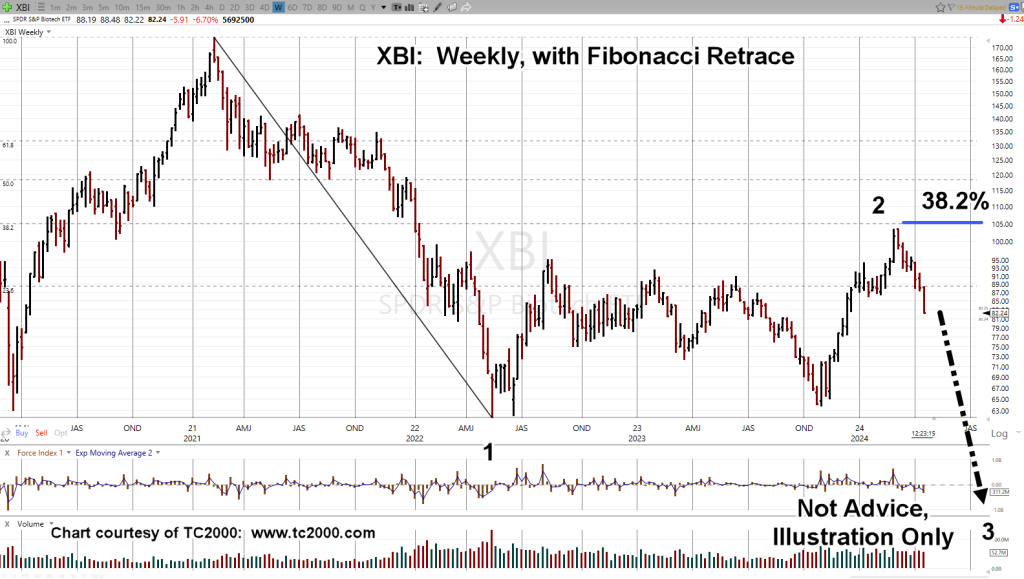

We’re at Fibonacci 55-Days, from the closing high on February 27th; today’s price action opened the session by penetrating highs of April 9th and April 11th.

Doing so, puts XBI in up-thrust (potential reversal) position.

Biotech XBI, Daily

We can say, XBI is at The Danger Point®

As this post is being created (10:34 a.m., EST) price action appears to be eroding from the early session push higher.

The typical market characteristic for XBI, is to retest in the second hour or so of trading; in this case that would mean a move back to the highs.

If that does not happen, it adds weight to the potential reversal scenario (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279