End Of The ‘Test’?

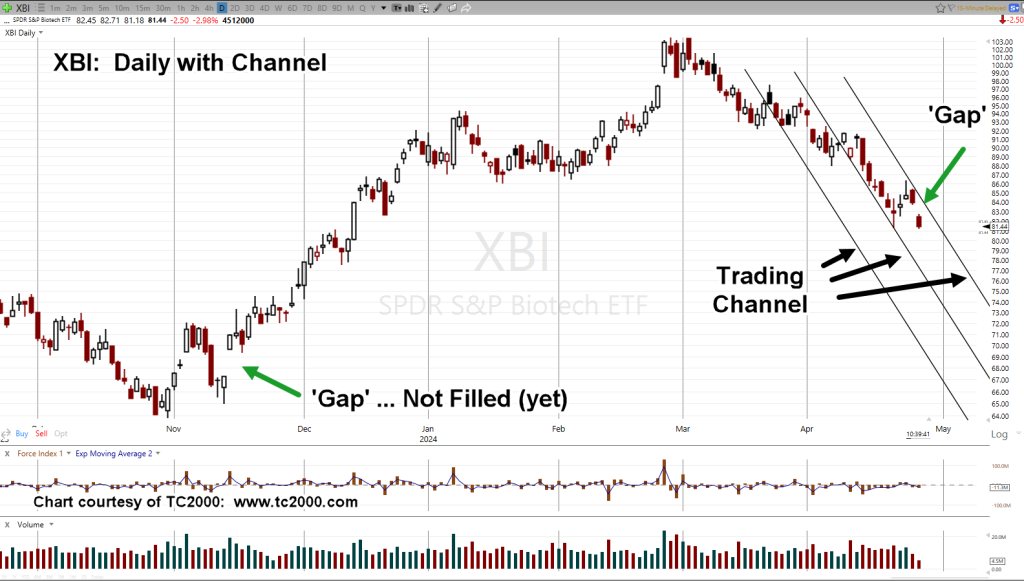

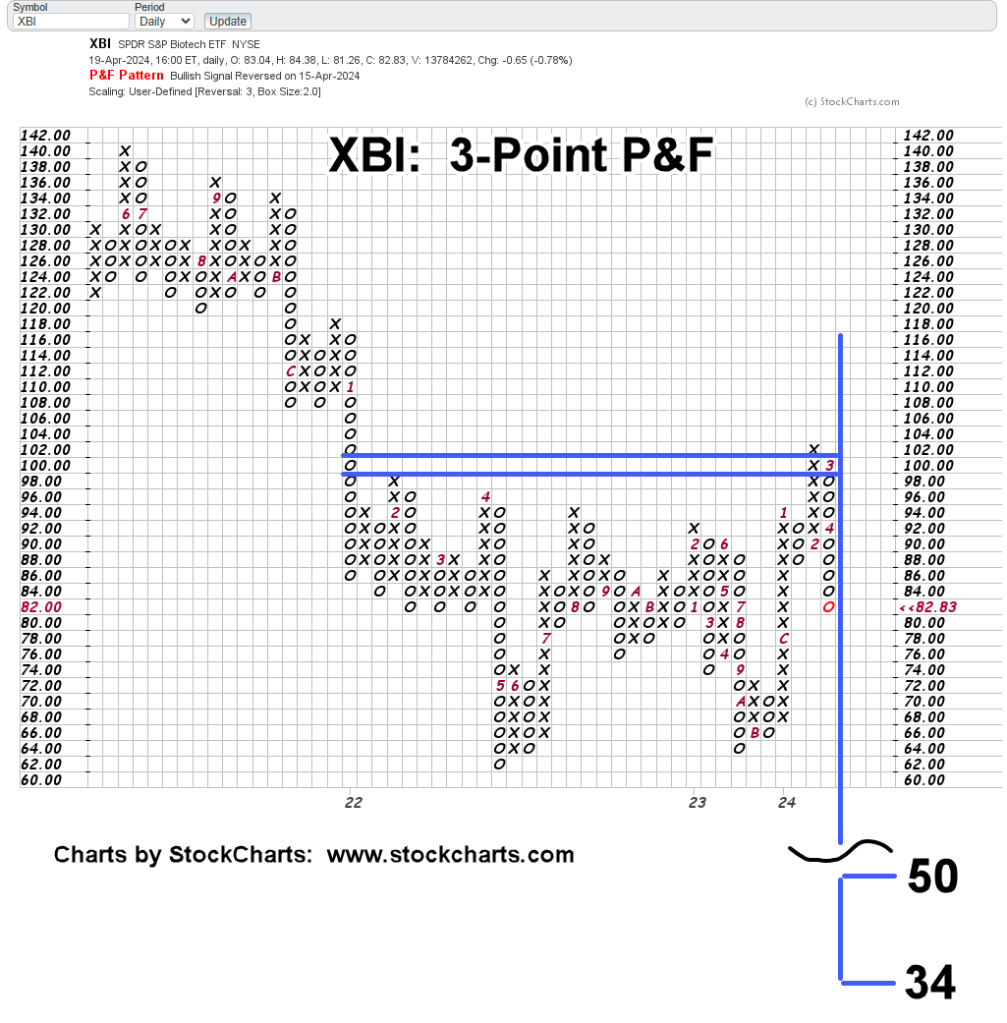

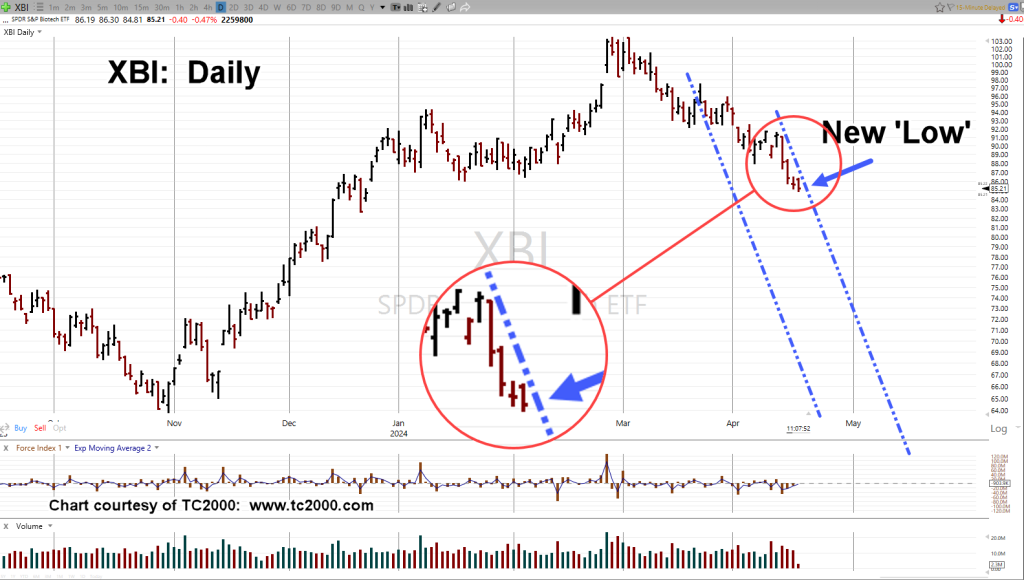

Was this morning’s launch higher in biotech a ‘gut-check’ of the up-thrust (set-up), or just filling the gap left from the April 2nd, move lower?

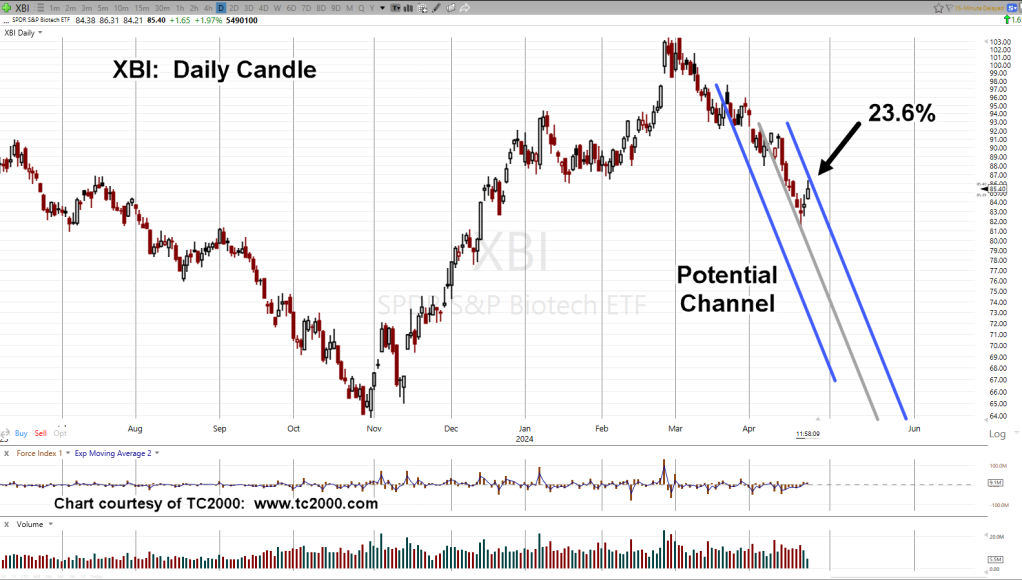

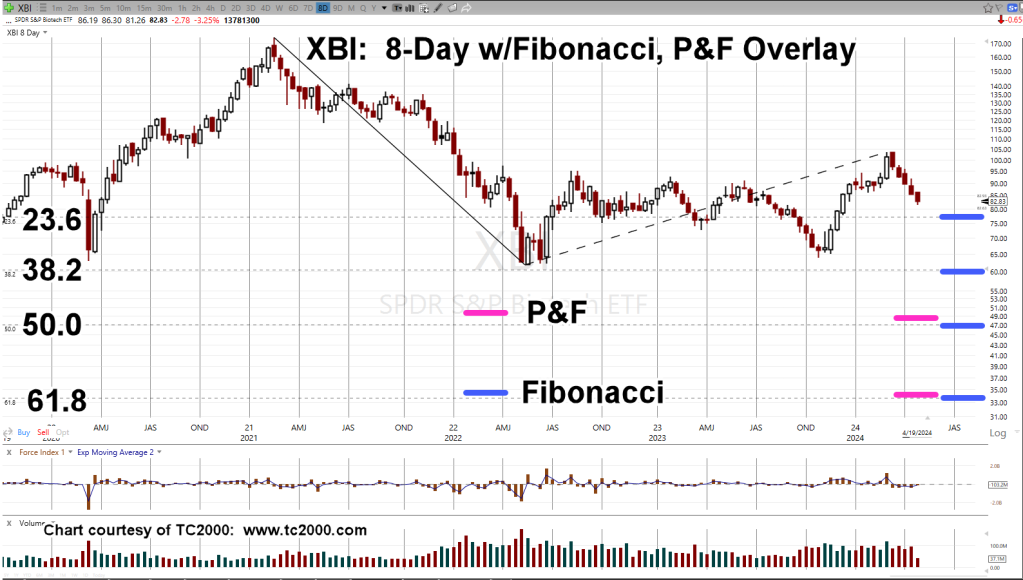

The Fibonacci 55-Day, count remains intact as it moves from the closing high of February 27th, to the ‘print’ high of the 28th.

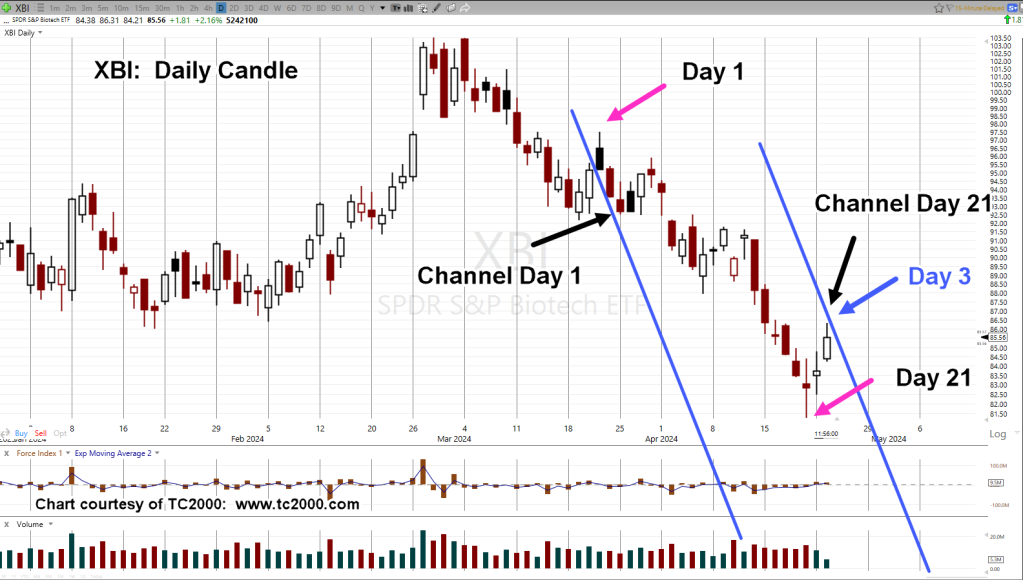

As of this post (10:40 a.m., EST), XBI has already retraced back to the top of yesterday’s trading range.

As we look at the chart, it’s important to note today’s early session high was 93.85, the exact closing price of the ‘gap’ created on April 1st, and 2nd.

Biotech XBI, Daily

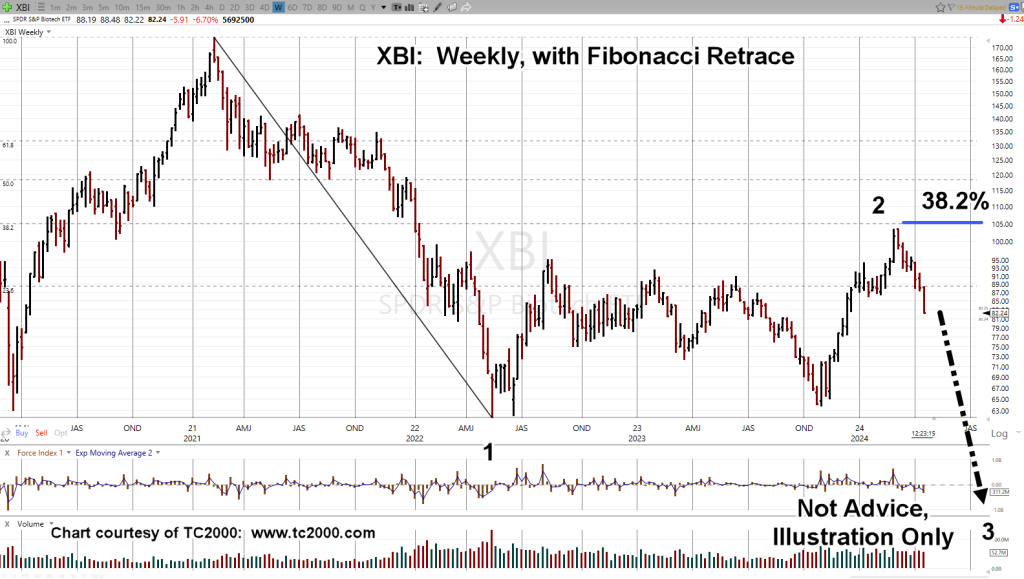

If this action really is just a test of the larger scale up-thrust (described here), one gets the sense a significant move lower may be at hand (not advice, not a recommendation).

We’re just over an hour into the session and XBI has posted a clean reversal bar for the first hour.

In the event there’s no significant move lower, and the set-up fails, today’s high represents a good stop level for a short position (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279