Losses For The Week, Erased

Monday’s losses were (mostly) recovered by the close on Friday.

One might be inclined to think we can all get back to ‘normal’.

Normal, like rigged elections, poking the bear (expecting nothing bad to happen), attempted assassinations, fake data, falsifying employment records, more ‘visitors’ flooding in, you know, normal.

However, for anyone paying attention, the charts say we’re at The Danger Point® (not advice, not a recommendation).

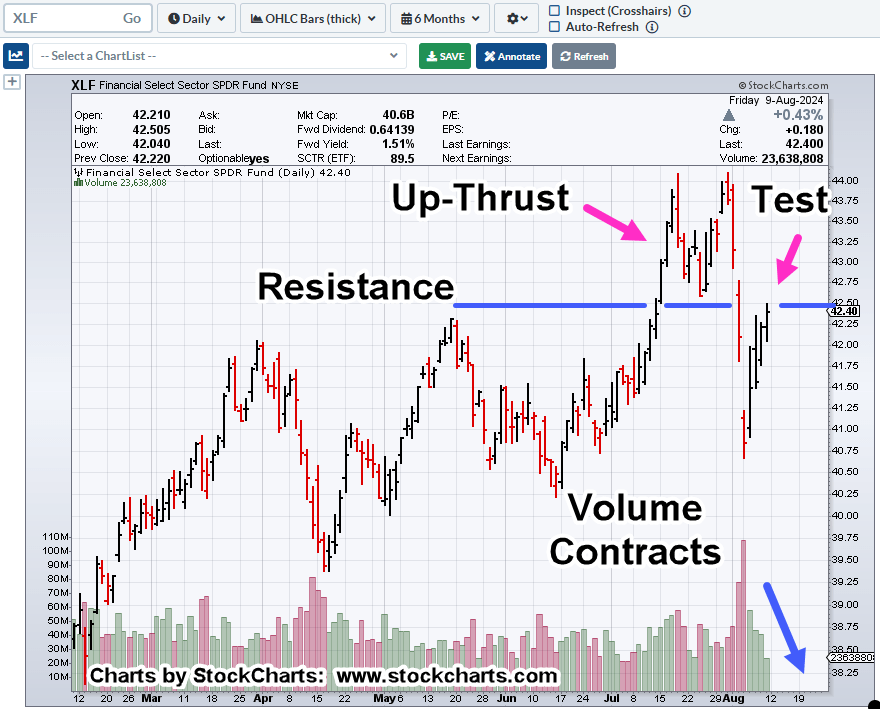

The potential for biotech XBI, has been covered over the past few days (here and here), but we also have another potential set-up; the finance sector, XLF.

We’ll cut to the chase, with the chart.

Finacial Sector, XLF, Daily

It’s important to note: It was four days of retrace (upward) into the test; each day had less volume than the day prior.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: When To Go ‘Short’ « The Danger Point®