Has The Plug Been Pulled?

More distribution takes place on the way down, than on the way up.

From the book ‘One Way Pockets’, first published in 1917, analyzing actual client accounts and trading behaviors, we have this (paraphrasing):

‘It was from pullbacks of record high prices, where the most distribution took place’

It’s a psychological, repeatable, phenomenon. We know it today as ‘Buy the dip’.

The problem is, buy the dip doesn’t work when the trend changes from up to down.

All of which brings us to ‘Signs of the SOXX’.

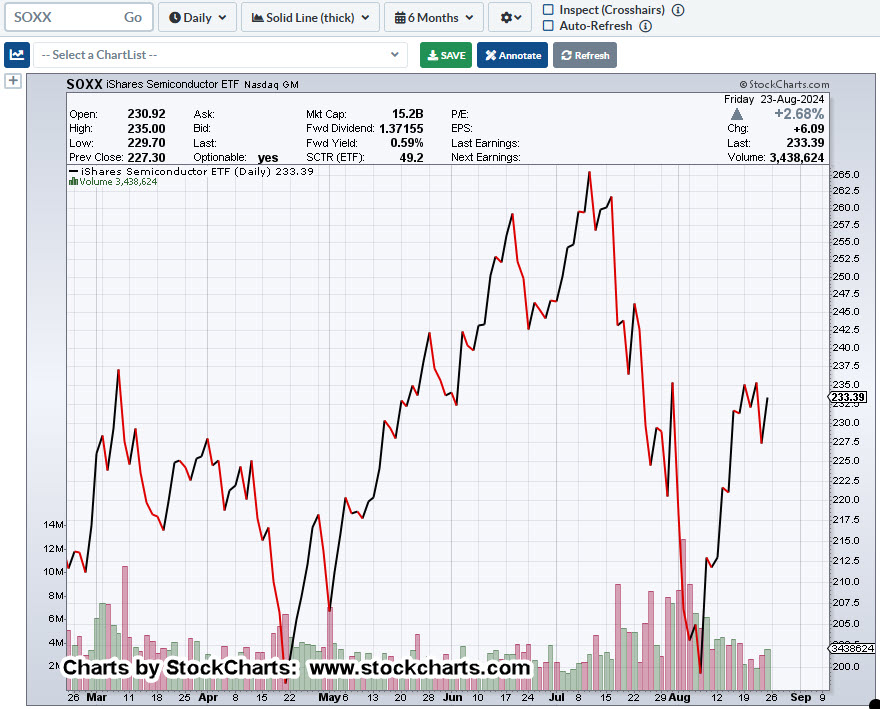

Semiconductors SOXX, Daily Close

“What do you see?”

Marking up the chart, we see the SOXX, is potentially at the confluence of both resistance and trendline.

Another label for the possible ‘contact’ is:

The Danger Point®

This is where the risk of being wrong on a short position is least (not advice, not a recommendation).

With the Fed release taken as ‘good news‘, it’s reasonable to propose all the good news maybe already out.

Who’s left to buy?

The ‘Right’ Answer

If we just saw a test of resistance (solid black line), then there’s only one (or a variation of one) right answer at the next session.

That is, SOXX, price action (by the close) to be either net sideways or down (not advice, not a recommendation).

If that does not happen, and there’s buoyancy in price action, one can conclude there’s (seller) ‘absorption’ taking place at these levels.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279

Pingback: August 25th, 1987 « The Danger Point®

Pingback: The Power Goes Out on Nvidia « The Danger Point®