Rates Spike Big Time … Who Could Have Guessed?

Let’s use the ‘Way Back’ machine with Mr. Peabody and return to this post.

Back in mid-August, that analysis presented rates heading higher (not lower), as more probable.

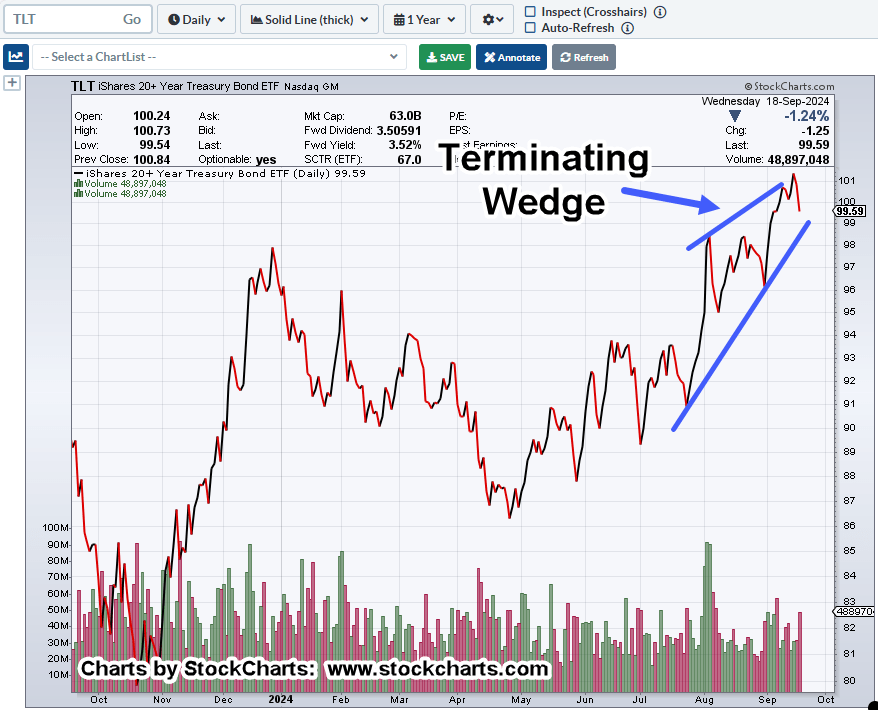

One month after that, this update showed a ‘terminating wedge’ in the bond market, TLT.

Now, two and a half months after the first post, the rate spike’s hitting the news.

Once again, you have to ‘subscribe‘ to find out what’s already happened. Hmmm

Contrary Indicator

The fact rates are just now in the mainstream, could (as we’ll see below) indicate a potential hesitation of downside or an upside retrace.

Long Bonds TLT, Daily Close

We’ll start first with the original ‘wedge’ post.

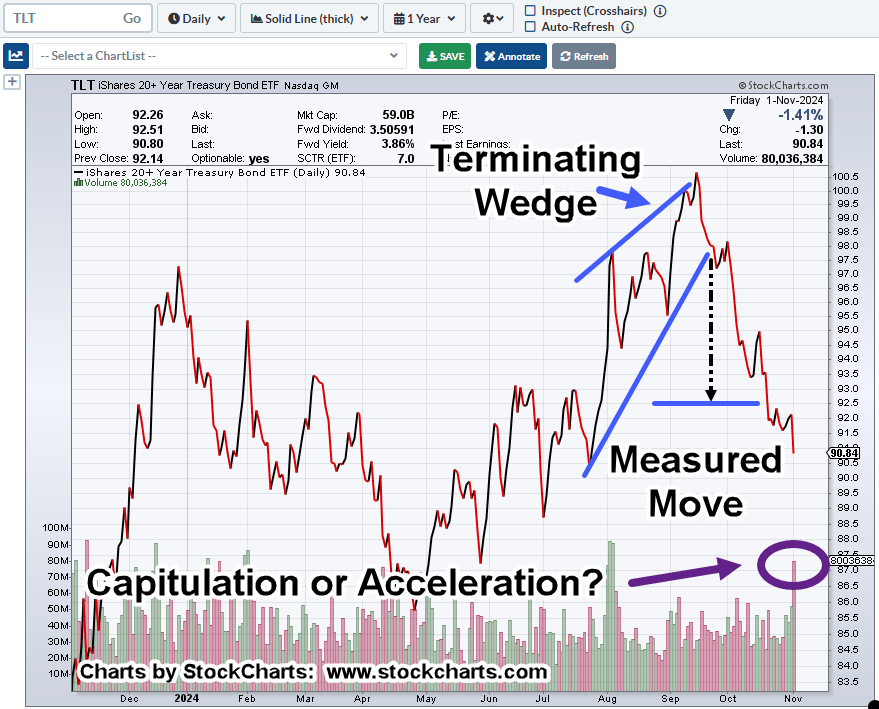

Now, for the updated version.

Obviously, there’s a lot going on in the chart.

Price action blew-through the measured move and has (potentially) culminated in a downside wash-out.

Or, behind Door Number 2, it could be a signal, rates are about to press-on higher like a juggernaut (not advice, not a recommendation)

The Fed Rides Again

Remember our last post on the Fed (possibly reversing the reversal), said to get your popcorn ready.

Looks like the show’s about to start.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279