Ruh, Roh, Scooby

Well, Scooby … looks like we’re in trouble, now.

Actually, it’s the A.I. bubble, that’s in trouble (not advice, not a recommendation).

To start things off, here are a few (A.I.) notes from the article at this link:

‘significant near-term headwinds’

‘diminishing returns’

‘hit a proverbial brick wall’

‘not lived up to expectations’

Need we go on? Why not. 🙂

‘increasingly challenging’

‘massive costs’

‘might be a pipedream’

Well, I think that sets the stage.

Before getting to the chart, let’s just add this one item.

While A.I. appears ready for a complete implosion, ‘investors’ have rarely been so optimistic, link here.

Of course, from a Wyckoff standpoint, the chart below, has already told us what’s likely to happen next.

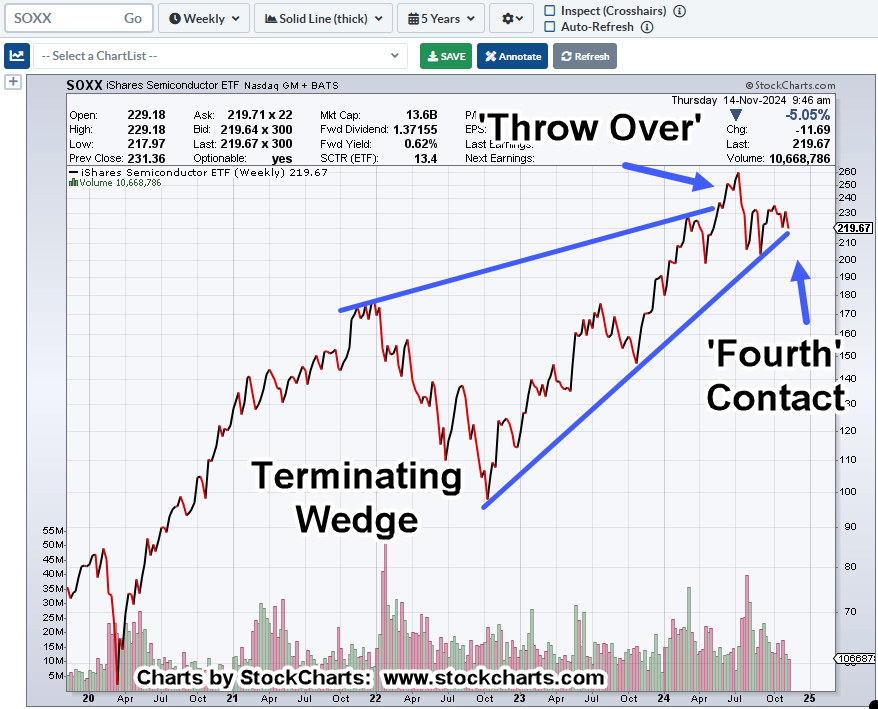

Semiconductors SOXX, Weekly Close

Price action’s (potentially) in a massive terminating wedge, three-years in the making.

Note, the SOXX is at the trend-line for the fourth time.

An old Wall Street adage, the source of which was lost long ago said, ‘when the trendline is challenged for the fourth time, there’s typically a break’ (not advice, not recommendation).

Let’s see if that happens now.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279